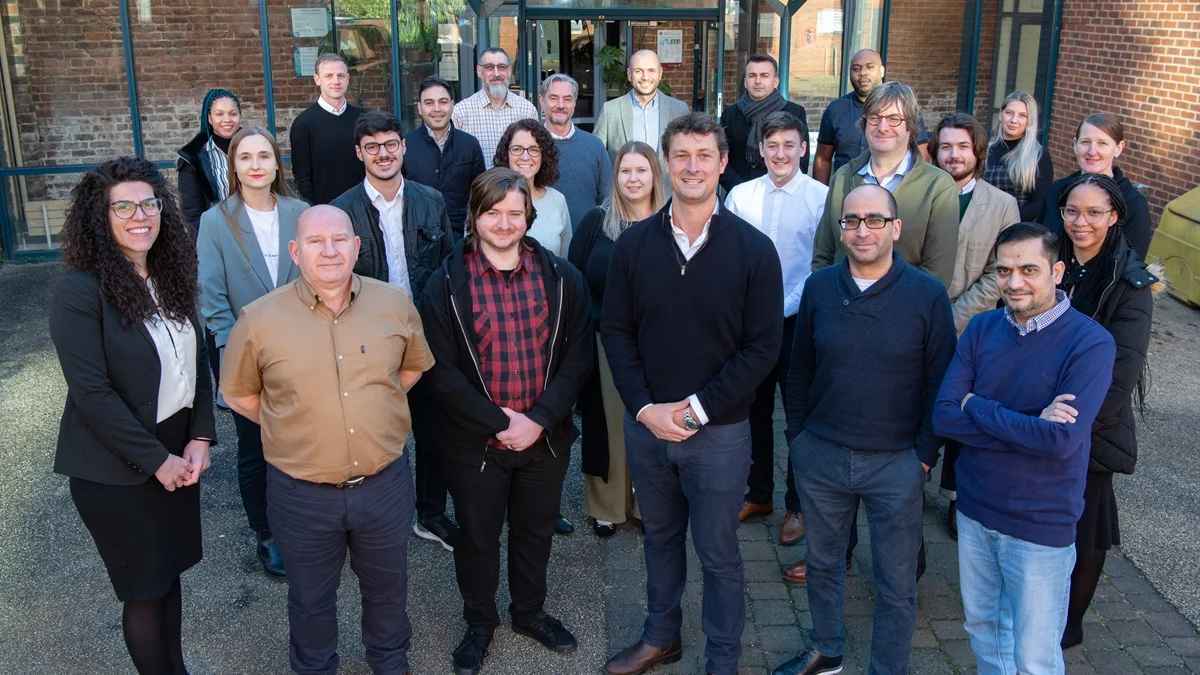

“It started in a pub, then Andrew's spare bedroom and today we have our 10,000 sq ft inspection and logistics facility in Leeds,” say co-founders Matthew Ward and Andrew Lucas of IC Blue.

The company offers component sourcing and stock management to customers in the electronic manufacturing industry across 56 countries. This is a world of RAM, ROM, resistors, capacitors, transformers, amplifiers, diodes and the other components that form the intricate electronic brains ensconced on green laminate PC boards. These boards power everything from SpaceX rockets to toasters.

This sector is driven by design innovation and the journey of IC Blue is testament to necessity-driven perseverance as a survival strategy. A whim from a president, a 0.1-degree increase in the global temperature, or a sudden advance in nanotechnology can trigger boom and bust cycles for PC board designers and the companies that use them.

Where the company is today

“The past five years have been the toughest,” says Ward. The impact of Covid-19 on the industry was profound as manufacturers worldwide closed factories and the supply of components dried up. This was amid significant 5G projects rolling out across Northern Europe and the UK. Demand skyrocketed, but it was like shooting fish in a tiny barrel. Unfinished products cannot be shipped; the cashflow implications and costs are devastating if they can't.

“We responded by sourcing unused inventory from customers that had overbought components that newer generation components had superseded. We tested them, assured their integrity and sold them to customers that needed to get the product out the door," says Ward. IC Blue's revenues peaked at £40m during the second year of the pandemic, a testament to its ability to navigate through challenging times.

Once the pandemic subsided, the landscape shifted once again. Established buyers in the industry retired, but new buyers lacked the legacy of knowledge and intuition created by working with generations of competent advances. Interest rates and geopolitical ructions slowed capital investment down.

Alongside this, the cadence and momentum of EV investment and 5G rollout have slowed as component manufacturers have returned to total capacity. Oversupply in the market has squeezed out margins, while manufacturers go directly to big customers to regain it.

“The middleman is constantly being squeezed out, so we need to adapt again,” says Ward. “In an industry where size matters, we are the oil between the giant cogs that close gaps between demand and supply.”

A vital survival skill is seeing and reading the impacts of escalating geopolitical battles, the pace of climate change legislation and regulation, armed conflicts, or trade wars on everything from smartphones to EVs.

The need for constant adjustments

Ward admits he has to make constant adjustments to the business. The company currently employes 30 people, down from 50 and has had to shift its value proposition to retain and acquire customers.

“It used to be we have stock. Then, it was that we have an alternative to the components you want but cannot get. Then, it was about quality," he says. "Today, it’s about helping you save money and reduce failure by advising you on stock holding and component selection. It’s a never-ending process of re-engineering our propositions. What allows us to do it is our establishment.”

With more than 22 years of trading data and having sold over 200 million components, Ward turned to AI and machine learning to turn historical data into intelligence and insights that help customers make better, data-driven decisions. It’s working and revenues have again risen after collapsing post-Covid.

Scale, growth and value perspectives

Reading and responding to the earliest signals of change in an industry allow a company to lead in its industry. If it’s a fast-moving and constantly changing industry, winning requires a business model that sees the first changes before anyone else.

Getting this right is the difference between leaders of change and those who, out of necessity, become followers. The signals come from many areas: sales get it from new customer acquisition attempts, operations from fulfilment and service from retention efforts.

An approach termed Reset-Rebuild-Reignite saved many companies during Covid-19. It’s designed to read early signals of change, respond to them and do so with the team and customers as collaborators.

Reset: Organise customers into similar segments. Identify the biggest and the smallest customers in each segment and establish relationships outside the sales team. Speak with the leaders in those businesses annually or bi-annually to understand the changes they see in their customers and how they intend to respond. Get sales team to speak to their top three customers and corroborate the changes. If you have a significant supply chain, do the same with your suppliers.

Rebuild: Discuss with the team what changes must be made to offerings and value propositions. Include team members across customer acquisition, fulfilment and retention. Once there is alignment on the changes, adjust the activities across marketing, sales, operations, procurement and administrative processes – and have team leaders implement them. Cementing these changes into daily, weekly and monthly operational activities is vital.

Reignite: With adjusted propositions, invest in customer acquisition activities. Ward excelled in this and used the data accumulated across his customer base to support, guid and empower his customers to make better decisions regarding quality and cost outcomes, earning a 33 per cent increase in sales in just one 12-month cycle.

IC Blue is the Zara of the component industry. Fast fashion is a business model before its intuition, luck or opportunism. As the rate and pace of change increase across all economies and industries, engineering businesses to acquire the earliest signals and aligning teams to adapt lets them lead their industries rather than constantly trying to keep up.

Growth Engines showcases remarkable yet frequently under-recognised business owners who collectively form the basis of our economic engine and whose entrepreneurial fortitude creates a more inclusive and prosperous Britain. It shares their journey, highlighting hard-earned insights and lessons on overcoming challenges and driving business growth.

Its creator, Pavlo Phitidis, is a founder of Aurik, a business scale and growth execution platform for established business owners. He also speaks internationally and authored two books: Sweat, Scale Sell: Build Your Business into an Asset of Value and Reset, Rebuild, Reignite: Turning Crisis into Opportunity

Related and recommended

Fashion entrepreneur Dessi Bell explains why customers are looking for something different when they shop on the high street

Think assistants are just admin managers? Think again. They might be your greatest business asset

The home appliances inventor and entrepreneur explains what he’s learned from sponsoring Brentford FC

An ill-fated product launch 40 years ago became one of the biggest marketing blunders ever and still holds lessons today