For every big name in business, there are understudies that act as sounding boards, confidants, and trusted ears. The world was reminded of the influence that a number two can have in life and business when Charlie Munger passed away just shy of his 100th birthday.

We break down a few notable number twos and look at their relationships with some of the biggest names in business and beyond.

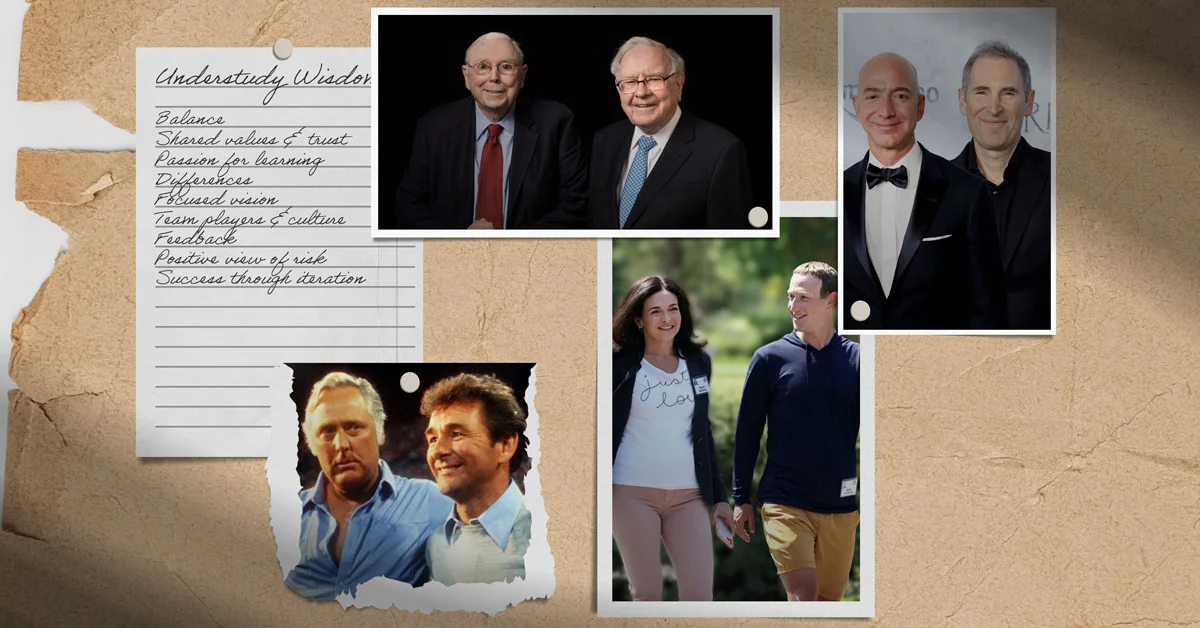

Warren Buffett and Charlie Munger

In an official statement following Munger’s passing, Buffett said, “Berkshire Hathaway could not have been built to its present status without Charlie’s inspiration, wisdom and participation.” High praise for a company with such humble roots that has sprouted into a $800bn (£630bn) investment giant.

The power of the pair’s relationship is the balance. Buffett had the proverbial velvet gloves and is often associated with the words “patience” and “humility”. Munger on the other hand, was notoriously blunt, with quotes such as “every time you hear EBITDA, just substitute it with ‘bullsh*t’” attributed to him. However, the relationship was rooted in shared values and trust.

Another shared love the pair had was a passion for learning. In his book Poor Charlie's Almanack, Munger said, "In my whole life, I have known no wise people (over a broad subject matter area) who didn’t read all the time - none, zero. You’d be amazed at how much Warren reads - and at how much I read. My children laugh at me. They think I’m a book with a couple of legs sticking out.”

Whilst Buffett isn’t known as having the abrasive, conflict-inducing personality of a Musk or Jobs, the reverence in which the Berkshire Hathaway duo spoke about each other, even with an almost 60-year partnership behind them, is truly beautiful. In a 2014 interview, Buffet said, “Charlie and I have never had an argument. We’ve disagreed on a lot of things. And it’s just never led, and never will, lead to an argument.” And what about when they did “disagree”? Buffet says that Munger would say “Well, you’ll end up agreeing with me because you’re smart and I am right.”

“My system in life is to figure out what’s really stupid and then avoid it.” - Charlie Munger

Brian Clough and Peter Taylor

While the Munger/Buffett relationship was strong until their later years, the Clough/Taylor one had a far sourer conclusion. The pair met in their playing days at Middlesbrough and achieved dizzying heights as a managerial combination. They took a team from Nottingham, a city known for Robin Hood and being the birthplace of traffic lights and retail giant Boots, to the top of European football twice. For context, since the competition’s launch in 1955, relative sporting minnows Nottingham Forest has the same number of European titles as every one of the 17 London-based clubs combined.

The Clough-Taylor relationship was beautifully symbiotic, and their differences are what made them such a strong leadership duo. “I’m not equipped to manage successfully without Peter Taylor,” Clough once said. “I am the shop window, and he is the goods in the back.” Clough and Taylor also shared the importance of a focused vision – that wasn’t too complicated. Clough reportedly subbed off Nottingham Forest's Neil Webb after he scored from beyond the box, despite being instructed to only take shots from inside the box.

Both had a keen appreciation that team players were more valuable to the collective and culture than a big-headed superstar. The pair famously would interview potential signings and, as Taylor mentioned in his autobiography With Clough, by Taylor, they would explain “how we manage. If you approve of that now, don’t complain afterwards”.

“One of the worst crimes you can commit in life is to ask people to deliver something they haven’t got. That destroys them totally…” – Brian Clough

Mark Zuckerberg and Sheryl Sandberg

“One of the reasons the company is doing so well is because the two of them get along so well.” That’s what the former CTO of Facebook Mike Schroepfer said about the Zuckerberg and Sandberg partnership in 2010, when the company was worth around $50bn (£39.3bn). Today, the juggernaut is worth around $900bn (£709bn) and although Sandberg stepped down as COO in August 2022, her imprint looms large over the company’s success.

Sandberg joined Facebook in 2008, having worked at McKinsey & Company, Google, and with the then United States Secretary of the Treasury Larry Summers. Sandberg was 39 when she joined the company, and Zuckerberg was 14 years her junior. A 2010 New York Times article describes Zuckerberg as “socially awkward and reserved” but “Sandberg is the opposite: polished, personable, chatty and at ease in the limelight”. Despite being the “adult in the room”, she respected his vision for the company.

“I knew that the most important determinant of my performance would be my relationship with Mark,” she said in a 2015 graduation speech at Tsinghua School of Economics and Management. She explained how he agreed to give her feedback every week so that anything that bothered him would be aired and discussed quickly, as long as it was reciprocal. The pair stuck to the routine of meeting every Friday afternoon, but “as the years went by, sharing honest reactions became part of our relationship”.

The pair also shared a positive view of risk. Zuckerberg famously stood up at a company meeting and said, “We’re going to be a mobile-first company,” which was not the direction of travel in tech at the time. The next day, people continued to show desktop screenshots because that’s what they knew how to build. He then said, “No more meetings unless they’re mobile screenshots first.” Reflecting on this story on the Masters of Scale podcast, Sandberg said, “Just by making that change, he made the shift in the company. We really had to force it. The company really got on board, but it meant retraining a lot of engineers.”

"The upside of painful knowledge is so much greater than the downside of blissful ignorance." – Sheryl Sandberg

Jeff Bezos and Andy Jassy

A regular in the top five list of biggest companies on the planet, Amazon was founded by Jeff Bezos in 1994. Three years later, newly minted Harvard Business School graduate Andy Jassy joined the company not fully understanding his role. Fast forward a few decades and he scaled Amazon Web Services into the company’s profit engine. Jeff Bezos named Andy Jassy as his replacement as CEO in 2021. But Jassy had been well-prepped for this responsibility.

Ann Hiatt, Bezos’s former executive business partner, says that Bezos knew that he could be an intimidating character, so one way that he inserted some humility into his leadership was creating a brand-new position. Jassy’s role as ‘Shadow’ was to be his “brain double”. He was copied into every email and sat in every meeting to ensure he had the same context as Bezos. This enabled him to poke holes in all of Jeff’s favourite ideas, help him see around blind corners and make sure that he didn't become either too dominant in a conversation or create a culture of complacency in the organisation.

This ability to question his superior’s thinking about what is best for the company has been key to Amazon’s success. Jassy pointed out in a 2020 speech that just 83 of the Fortune 500 companies from 1970 are still on the list -- and only half are on the list from 2000. The shared ethos was articulated in a 2018 letter to Amazon investors, with Bezos saying, “Success can come through iteration: invent, launch, reinvent, relaunch, start over, rinse, repeat, again and again.”

“You can’t wait for things to be perfect; it’s better to go sooner rather than later.” – Andy Jassy

Related and recommended

The advertising veteran believes that leaders need to listen to those around them to set the right course for the business

Burnout is a serious problem for many leaders, but if you can spot the signs, you can stop it – and recover

With Labour committed to spending more on defence, we need to be clearer on the trade-offs – while realising ultimately it can boost the economy

Labour believes a trade deal with the US will change its political fortunes, but there are numerous obstacles in the way