Business banking plays a pivotal role in the growth and success of mid-sized businesses. Complex, scaling businesses, which often find themselves underserved by digital banks focusing on micro or startup companies, require tailored banking solutions to navigate their unique challenges and seize opportunities for expansion.

However, traditional high-street banks often overlook these businesses, falling short of meeting these needs, and leaving a significant gap. This is where OakNorth, the digital bank for entrepreneurs, by entrepreneurs, comes in.

Understanding the needs of mid-sized businesses

According to the Competition and Markets Authority, a staggering 85 per cent of SMEs bank with major institutions such as Barclays, Lloyds, HSBC, NatWest and Santander. Despite this, many businesses report frustrations with these banks' legacy technology and outdated processes. From the slow and cumbersome onboarding processes to the lack of timely access to necessary products and support, these issues can significantly hinder a business's growth trajectory.

At OakNorth, we've listened to these concerns and developed a business banking solution designed to address the specific pain points of mid-sized businesses. Since our inception in 2015, we’ve supported numerous trailblazing businesses, injecting more than £10bn into UK communities. Our focus is on empowering high-growth businesses with a turnover of £1m+, real estate assets over £1m, or over £100k in deposits, helping them to scale at speed.

The importance of personalised and interconnected services

Working alongside founders, CFOs, CEOs and directors, we’ve built an offering from the ground up that scales with businesses and their aspirations, and which addresses their unique pain points. For example, a significant challenge for many mid-sized businesses is the lack of personalised and interconnected services from traditional banks. High-street banks often fail to provide the dedicated guidance and support that these businesses need to navigate their growth plans and everyday banking requirements. This disconnect can lead to missed opportunities and hinder a business's ability to form strategic partnerships with their bank.

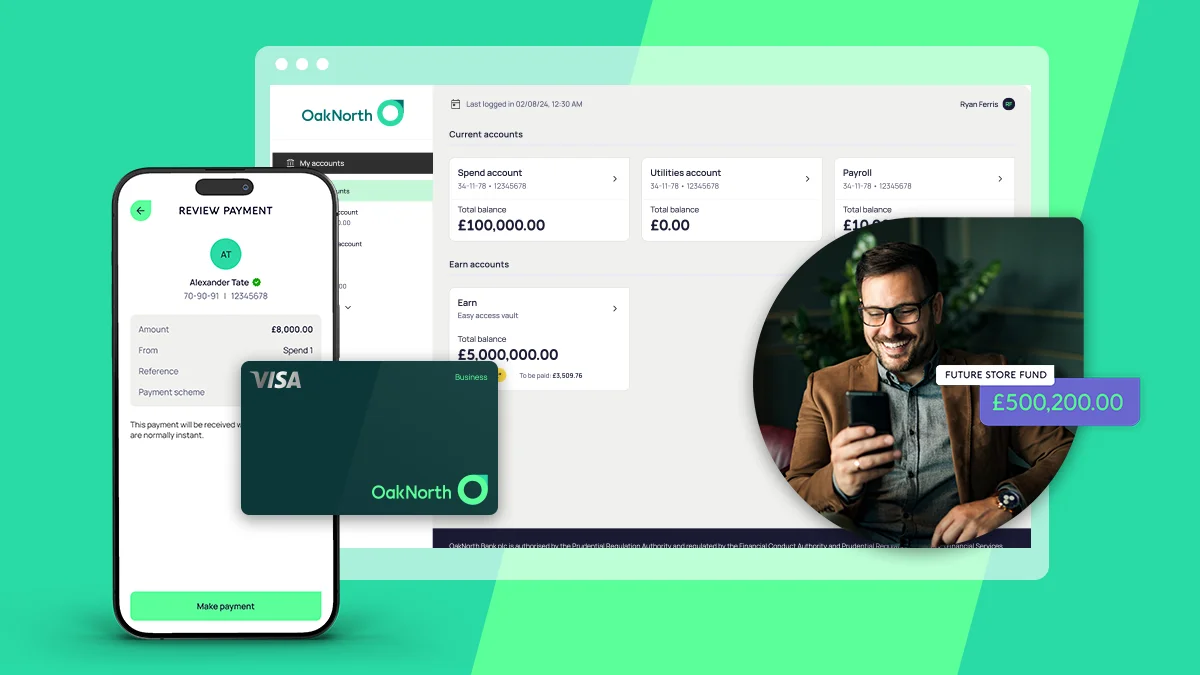

At OakNorth, we address this issue by offering a holistic banking service that includes current accounts, up to 4.75 per cent AER* on business savings, Visa debit cards and payment solutions. Our customers benefit from a dedicated Business Partner who provides timely and personalised support, whether they need to add a new user to their account or discuss a potential business opportunity. This approach ensures that our clients receive the tailored guidance they need to succeed.

Empowering growth through innovation

We’ve combined industry expertise with tech innovation to create a business banking solution designed specifically to empower high-growth businesses. Our quick and straightforward application process (under 10 minutes to complete) allows businesses to be up and running within a matter of days, not weeks or months. We’re passionate about ensuring our customers spend less time on banking admin and more time on the important stuff, like growing their business.

OakNorth is a fully regulated UK bank with FSCS protection on eligible deposits. We also offer customisable solutions such as multi-user access, payment approvals and free Visa debit cards for teams.

Business banking is not just about managing finances, it's about fostering growth, enabling innovation and building strategic partnerships. For mid-sized businesses looking to scale, the right banking partner can make all the difference. OakNorth is dedicated to challenging the status quo of business banking, providing the expertise, support and innovative solutions that ambitious businesses need to thrive.

We invite you to join us on this journey and experience the difference that a dedicated and forward-thinking banking partner can make.

You can learn more about OakNorth business banking here or get in touch with its expert team to discuss your unique business needs.

* 3.60 per cent AER on easy-access savings and 4.75 per cent AER on 95-day notice account. Variable rates correct as of August 2, 2024. Terms and conditions apply.

Related and recommended

The real value of artificial intelligence lies not in replacing people but in collaborating with humans’ unique creativity

The discipline it takes to be a top chef “also works well in the boardroom”, according to Chris Galvin, the chef patron of Galvin Restaurants

Castore went ahead with its recent acquisition of Belstaff from Sir Jim Ratcliffe’s Ineos only when it was satisfied five key criteria had been met

Raising the state pension age to save billions may seem attractive to a cash-strapped government but returns from earlier rises are dwindling