This article is an online version of our Off to Lunch newsletter. Sign up to receive it straight to your inbox here.

Nvidia is the darling of global markets. The company’s rapid rise saw it leapfrog Microsoft as the world's most valuable publicly traded company, with a market cap of more than $3.3tn, for one day in June. However, the chipmaker’s closing share price yesterday has many analysts whispering about the AI boom coming to an end.

The company’s share price opened yesterday just below $120 but closed trading at $108, a drop of just over 9.5 per cent. The fall wiped $278.9bn off the company’s market cap, taking it to $2.65tn. This marks the biggest loss of value ever for a US stock.

Last week, despite reporting record second quarter sales of $30.04bn, the company’s share price plummeted 8 per cent with investors seeing the company’s sales forecast for the third quarter as too low.

Bloomberg reported late last night that the US Justice Department sent subpoenas to Nvidia, as it steps up its antitrust investigation: “Antitrust officials are concerned that Nvidia is making it harder to switch to other suppliers and penalises buyers that don’t exclusively use its artificial intelligence chips, according to people who asked not to be identified because the discussions are private.”

This report led to the company’s share price falling a further 2.4 per cent lower in after-hours trading. The company was down again this morning, just under 2 per cent, in pre-market trading today. This share price fall has created a domino effect on the S&P 500 index and in many Asian markets. Japan's Nikkei 225 closed down 4.25 per cent, while South Korea's Kospi was 3.15 per cent lower and the Hang Seng in Hong Kong ended the day 1.1 per cent down. The FTSE 100 is down just over half a per cent at the time of writing.

The Institute for Supply Management’s Purchasing Managers Index shows that US manufacturing contracted in August. It also found that a further decline in new orders and a rise in inventory suggested factory activity could remain subdued for a while. This raises concerns once again that the US could be on the brink of a recession.

A US interest rate cut has been all but confirmed by Fed Chair Jerome Powell, who in a speech on August 23 said: “The time has come for policy to adjust”. However, JPMorgan has warned that investors who think a rate cut will generate a fresh dose of equity momentum could be mistaken. Should the finance behemoth’s pessimistic prediction be correct, a recession may be on the cards.

Business Agenda

A summary of the most important business news

By Sarah Vizard

1. Business leaders are concerned over plans by the government to make unfair dismissal a “day one” employment right. At a meeting with ministers, bosses from companies including Octopus Energy, Sainsbury’s and John Lewis discussed reforms to workers’ rights. The Times has the details here.

2. The chancellor Rachel Reeves has promised to produce a “tax road map for business” in the Budget next month that will include a promise to cap corporation tax at 25 per cent for the rest of the parliament. The move is aimed at providing a stable medium-term environment for business investment. Business groups have welcomed the move. You can read more here.

3. Revolut is to focus on expanding its business offering after global revenues from business accounts grew to £380m in the summer. Revolut Business offers cards and tools to control spending, as well as savings accounts and ways for companies to accept global payments. It has more than a quarter of a million firms using its business accounts and contributes between 15 and 25 per cent of its revenues. You can read more here.

4. The level of dealmaking among UK firms dropped to a four-year low in June, according to data from the Office for National Statistics. There were 93 completed mergers and acquisitions worth at least £1m in the month, the lowest since May 2020 when there were just 58 deals. The number of deals between April and June was 385, lower than the 463 completed between January and March. You can read more here.

5. The English winemaker Chapel Down's profits have fallen from £2.4m to £40,000 in the six months ended June 30 due to a difficult macroeconomic environment, a drop in the value of its produce and a tough comparison with 2023. Net sales were down 12 per cent, driven by a 36 per cent fall in sales in locations such as supermarkets and off licences. Its CEO Andrew Carter has also announced he is to stand down in the first half of 2025. You can read more here.

Business Question

Who am I?

- I was born on this day in 1930

- My first investment was in three shares of Cities Service Preferred at the age of 11

- Renowned investor Benjamin Graham was my mentor

- My company is influential but began life as a textile company

- It owns a diverse range of businesses, including insurance, railroads and consumer goods

- I have a plethora of inspirational quotes, including "Only when the tide goes out do you discover who's been swimming naked."

The answer can be found at the bottom of the page.

Business Thinker

Deep dives on business and leadership

?? David Epstein: 10,000 hours Is A lie! The morning habit that’s secretly ruining your day

The excellent David Epstein is the latest guest on Steven Bartlett’s The Diary of a CEO podcast. The author talks about how you can be more productive with your time (don’t check your emails first thing in the morning and don’t be overly optimistic when planning your time). But he also talks about his book Range, which looks at how having a broad skill set can be more effective than being a specialist. Epstein has also published a new foreword to his book, which you can read here. He advocates exploring, experimenting and making mistakes on your way to finding the best answer to a problem

??? The subscription value loop: A framework for growing consumer subscription businesses

A detailed look at what works well for consumer subscription businesses and how to get people to sign up. It is full of case studies, tips and tactics from the likes of Duolingo, Spotify and Masterclass

??? Dynamic pricing - definitely, or only maybe?

A great analysis on dynamic pricing from retail executive Ian Shepherd following the row about Oasis tickets. “The fact that the Oasis ticketing saga has got so many people upset suggests that the dynamic pricing policies being applied have indeed gone too far, are perceived as unfair and, at the very least, need to be explained better,” he writes.

Business Quote

Inspiration from leaders

“The road to success is always under construction.”

– Lily Tomlin

Business Leader

The best of our content

The surprising ingredient of the truly great

While talent often takes centre stage in discussions about success in sports and business, it is far from the whole story, says Business Leader expert Catherine Baker.

True excellence is achieved through relentless discipline, consistent hard work, and a commitment to mastering the basics—even when the spotlight is off.

The real difference between the best and the rest lies not just in talent, but in the daily habits and practices that sustain high-level performance over time.

You can read the article here.

Other popular pieces

??? The key to building a successful business? Finding your point of difference

?? Hawksmoor CEO: I believe in ‘casual professionals’

?? Ask Richard: Advisory boards, accidental managers and being a public company

And finally...

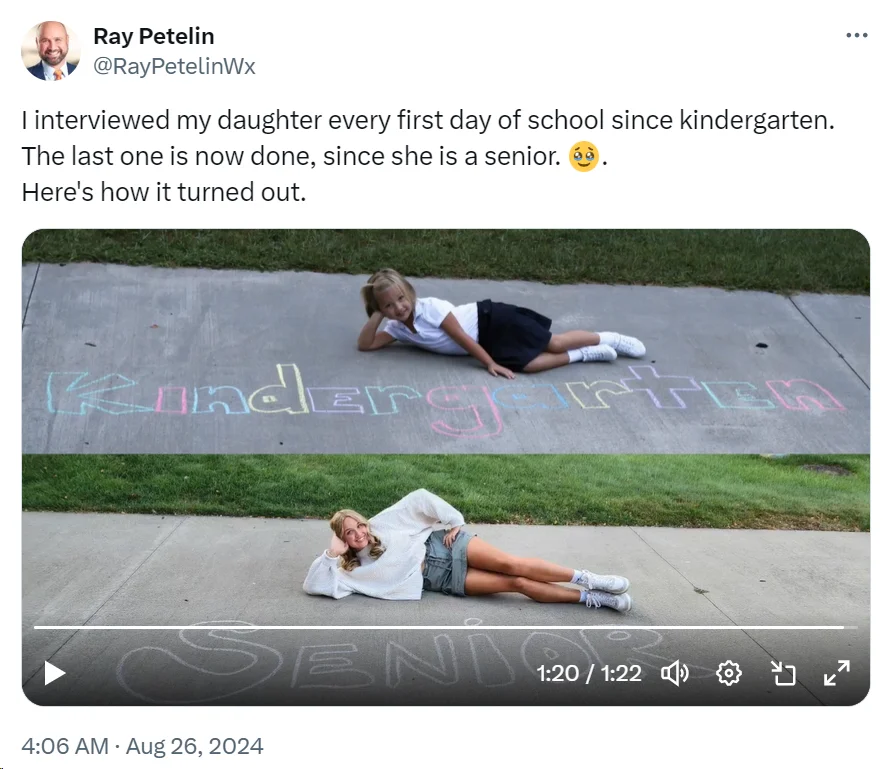

It’s back to school for most children this week. While many parents may be celebrating, it’s a stark reminder that there is a limited amount of first days of school. To capture this moment, Ray Petelin interviewed his daughter on every one of her first days of school and, since she’s now a senior, has pulled together a video.

The video has been viewed more than 37 million times on TikTok, 17 million times on X and 3 million times on Facebook. His advice? "People have probably heard this a million times, but it goes by very fast, so don't give up any single moment because when all is said and done you look back thinking, 'Wow, how did that happen so fast?'" Petelin told CBS Mornings.

You can watch the video here.

The answer to today's Business Question is Warren Buffett.

Related and recommended

The prime minister and chancellor may be safe for now but Cabinet ministers believe it’s a case of when, not if, they fall

After creating her own hair oil blends as a student, Lucie Macloud grew Hair Syrup into a multi-million pound business that she’s now expanding into Europe and the US

Thea Green, one of the UK’s most successful entrepreneurs in the beauty and self-care space, shares her advice

Nick Grey's story is a tale of grit, design obsession and the strategic choices behind sustainable success