This article is an online version of our Off to Lunch newsletter. Sign up to receive it straight to your inbox here.

By Sarah Vizard

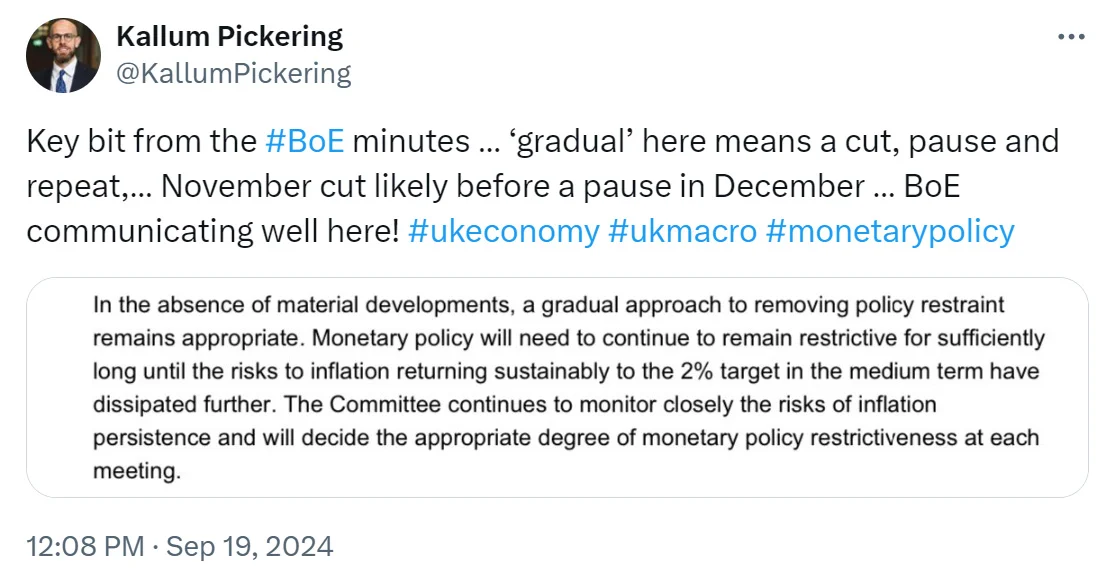

The Bank of England has kept interest rates at 5 per cent, resisting the temptation to reduce them for the second meeting in a row as it looks to sustain growth and employment while staving off high inflation.

At its meeting yesterday, the monetary policy committee (MPC) voted eight-to-one in favour of holding the rate, with just one member voting to reduce the rate by 0.25 percentage points.

In its reasoning, the MPC says it has been “guided” by the need to squeeze persistent inflationary pressures out of the system and get inflation back to its 2 per cent target on a lasting basis. It suggests that there are three cases for the economy: the first is the "unwinding" of global shocks that drove up the inflation rate dissipates; the second is that a period of economic slack, in which GDP is lower than expected and the labour market eases, may be required to “fully normalise” pay and prices; the third is that the economy may be subjected to structural shifts and therefore monetary policy would need to remain tighter for longer.

It concludes: “In the absence of material developments, a gradual approach to removing policy restraint remains appropriate. Monetary policy will need to continue to remain restrictive for sufficiently long until the risks to inflation returning sustainably to the 2 per cent target in the medium term have dissipated further.”

The decision to keep interest rates at 5 per cent was widely expected. Inflation remains stubbornly above the target of 2 per cent, coming in at 2.2 per cent in August. Inflation is expected to tick higher in the second half of the year, with household energy bills set to rise again in October.

The move comes as the US Federal Reserve yesterday cut interest rates for the first time in four years. Interest rates in the US had been at a 20-year high amid high inflation, but America’s central bank cut them by 0.5 percentage points to the range of 4.75 per cent to 5 per cent.

The head of the bank, Jerome Powell, described the move as “strong” but said it was necessary as price rises ease and concerns mount about the job market. He wants to ensure that high borrowing costs, put in place to bring down inflation, do not end up damaging the US economy.

While inflation eased to 2.5 per cent in August, the fifth month in a row it has fallen, the unemployment rate in the US has climbed from 3.7 per cent at the start of the year to 4.2 per cent, with hiring also slowing. New projections suggest inflation is falling faster and unemployment increasing faster than expected as recently as June.

"The labour market is in a strong place, we want to keep it there," Powell said. "That's what we're doing."

The bank’s forecast has signalled that rates could fall by another half percentage point by the end of the year. It follows rate cuts by a number of other central banks, including those in Europe and Canada.

All are trying to get the balance right between bringing down inflation but ensuring that economies and labour markets remain strong amid higher borrowing costs for businesses and consumers.

Business Agenda

A summary of the most important business news

1. Investors in Ocado and Next have reasons to smile today. Stronger summer trading has prompted Ocado to raise the outlook for sales growth this year, as the grocery delivery business gained more customers. Ocado Retail, the 50-50 joint venture with Marks & Spencer, reported a 15.5 per cent increase in revenue to £658m during the 13 weeks to the start of September, up from £570m a year earlier. Next has raised its profit forecasts for the second time in two months and increased first-half profits as it bucked the downbeat trend on the high street. The company reported a 7.1 per cent rise in pre-tax profits of £452m for the six months to July 27 and said it was on course to make annual profits of almost £1bn. You can read more about Ocado here and Next here.

2. Around a third of the UK’s office stock is at risk of becoming redundant in the next 10 years, according to a new report from Montagu Evans. The property consultancy says that this can be attributed to economic urbanisation, environmental obsolescence and changing work patterns. You can read more here.

3. Hostmore, the owner of the UK arm of the restaurant chain TGI Fridays, has gone into administration, putting 4,500 jobs at risk. The company has already tried to balance its books through deep cost-cutting, pausing its expansion programme, management changes and selling outlets. It has put 87 of the chain's restaurants on the market and hopes to complete a sale by the end of September, which would keep the brand name alive on British high streets and help to secure jobs. In the meantime, the American-inspired chain "continues to operate normally and all existing stores remain open", Hostmore said. You can read more here.

4. Sales at the UK arm of coffee brand Lavazza have jumped past the £100m mark for the first time. The Uxbridge-headquartered division’s turnover totalled £102.3m for 2023, newly filed accounts with Companies House show. You can read more here.

5. Boeing is preparing to furlough tens of thousands of employees to save money as a workers’ strike halts the manufacturing of its bestselling planes. Kelly Ortberg, Boeing’s chief executive, said a large number of US-based executives, managers and employees would be impacted “over the coming days”. The announcement comes as the company reels from the decision of more than 30,000 union members who build passenger jets on the west coast of America to strike over pay. The strike could cost Boeing several billion dollars, further straining the indebted aircraft maker’s finances, analysts have said. You can read more here.

Business Question

Who am I?

- I'm a Scottish-born 'Punk'

- In 2007, my friend and I set up a company in his mum's garage with £30,000 of life savings and a £20,000 bank loan

- We celebrated opening our first location by driving a tank through the streets of London

- Although I'm no longer CEO, I'm still captain

The answer can be found at the bottom of the page.

Business Thinker

Deep dives on business and leadership

By Dougal Shaw

?? Is the UK the 'sick man of Europe'?

The think tank the Institute of Public Policy Research has concluded a three-year study into health and prosperity in the UK. Its headline finding is provocative: “The term the ‘sick man of Europe’ is often used to describe countries going through severe economic turmoil or social unrest. In Britain today, it has become a more literal reality." The report says the UK is lagging behind its peers and estimates that 900,000 people have been lost to the labour force since the pandemic (compared to what would have been expected), costing HMRC £5bn in lost revenue this year alone. The report also found that the UK economy remains imbalanced, with prosperity still focused on London and the south-east. The whole report is worth a read. Although much of the emphasis is on health, it's very relevant to anyone who cares about managing a modern workforce.

?? The 'third wave' of AI

First, it was predictive, then it was generative, and now it seems the third wave of the AI revolution is going to be about increasingly sophisticated and autonomous chatbots. That's the vision that two giants of the SaaS world, HubSpot and Salesforce, have recently shared. In fact, this tallies with a conversation I had with Amit Bendov, the CEO of Gong, another AI-powered SaaS platform. He foresees a near future where chatbots do things like buy cars on our behalf. His software can already give employees tailored personal feedback instead of line managers. He even said: "Chatbots talking to each other in some form is inevitable, zero doubt in my mind.” You can read the article here.

Business Quote

Inspiration from leaders

“The growth and development of people is the highest calling of leadership.”

– Harvey S. Firestone

Business Leader

The best of our content

Gen Z ushers in the end of the untouchable boss

As social media transforms public perception, modern leaders face the challenge of authenticity amidst scrutiny. Business Leader Expert Caspar Lee explores how Gen Z's demand for transparency and genuine communication is reshaping leadership expectations, exemplified by the PR crisis of YouTube sensation MrBeast.

With the stakes higher than ever, today's executives must navigate a new landscape where sincerity is key to trust and success.

You can read the article here.

Other popular pieces

?? The art of business wargaming

?? Passion, optimism and humour: 5 tips to building a career you’ll love

And finally...

It's the latest hit video meme on social media and it is poking fun at the generation gap in modern workplaces.

It goes like this. Gen Z employees write the script about their workplace, then much older colleagues present it on video. They usually do it with a very wooden delivery, as you'll see in this latest example of the genre from the Royal Armoury Museum.

Earlier this month our newsletter mentioned the Work Foundation report, which noted that "for the first time in history, there are four generations in the workplace, with workers born in the 1950s and 1960s now working alongside people born in the 2000s."

These videos show there can be a divide at work, especially around language. Social media worlds have spawned their own vocabulary that only the initiated fully understand. But these videos are ultimately made as creative collaborations between people of different ages. So ultimately each video shows that despite age gaps, we can all work together if we embrace a shared spirit of fun!

The answer to today's Business Question is James Watt.

Related and recommended

Healthcare and income tax require radical reform, but the Budget revealed little ambition to tackle the big issues

Bob Skinstad’s journey from rugby prodigy to business leader is shaped by scrutiny, setbacks and second chances

After a decade as editor-in-chief, Katharine Viner is using her business acumen to reinvent The Guardian

The prime minister and chancellor may be safe for now but Cabinet ministers believe it’s a case of when, not if, they fall