This article is an online version of our Off to Lunch newsletter. Sign up to receive it straight to your inbox here.

While some of the UK workforce may be nursing a Euros-induced slow day, a report released today could make those monitoring the funding landscape for medium-sized business owners a little more optimistic.

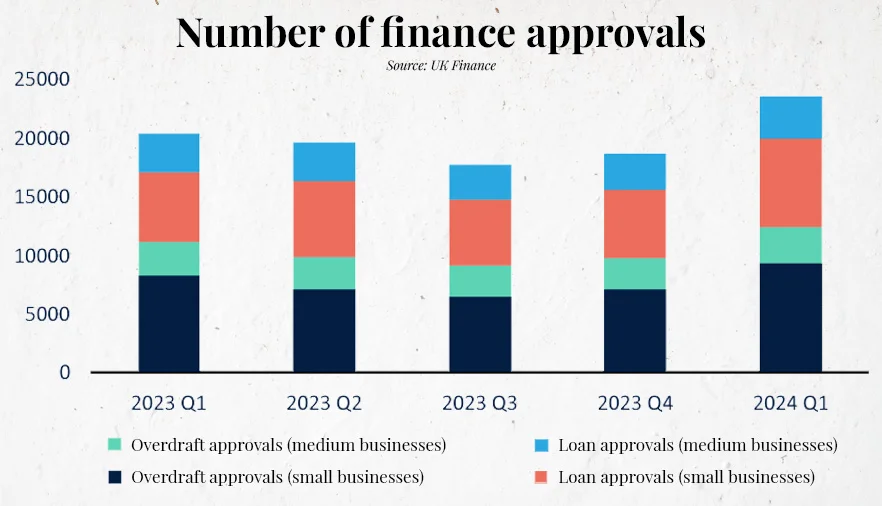

UK Finance has released its Business Finance Review report. The quarterly study looks at how the finance needs of SMEs are being supported through lending from mainstream lenders and specialised finance providers. The report’s headlines are that gross lending has increased to its highest level in almost two years, while there has also been a rise in the number of approvals.

Both the 15 per cent jump in gross lending and uptick in approvals come after the release of last month’s Commons Treasury committee report looking into access to finance. The report reviewed upcoming changes to SME lending but also encouraged banks to make borrowing easier.

UK Finance’s report reveals that overall finance approvals were 27 per cent higher in 2024 Q1 compared with the previous quarter, with the value of approved finance increasing by 10 per cent. Overdraft approvals were up 27 per cent and new loan approvals were 26 per cent higher than the previous quarter.

It says:

“These are positive first steps, particularly in signalling that the main high street lenders remain an important part of a diverse finance landscape for SMEs. However, given continued caution in the near-term economic outlook and the short-term political uncertainty that the election will generate, we’ll need to see growth in finance demands being sustained in the coming year before recovery is assured.”

SMEs have also continued to reduce the stock of cash deposits. Having peaked at just over £270bn in the fourth quarter of 2021, the figure now stands at £223bn. A decline of 4.5 per cent compared to the previous quarter, this was the fastest pace of decline recorded since the end of the pandemic.

David Raw, managing director of commercial finance at UK Finance, says: “It is encouraging to see further signs that SME demand for finance is returning. As the economic outlook for SMEs improves, the financial services sector is helping businesses across the UK. Lenders remain ready to support SMEs that need and can afford finance.”

This increase in available funding is only as useful to the nation's economy as the scaling businesses that are using it. However, banks and alternative lenders making money available to them goes a long way to solving one of the biggest problems most growing businesses have.

Business Question

Guess the year

- 1 in 10 companies set up in this year went into liquidation

- The mobile network BT Cellnet changes its name to O2

- TDR Capital, Loungers and Skyscanner were founded in this year

- BBC 6 Music, the first new BBC Radio station in decades, is launched

- Euro banknotes and coins become legal tender in twelve of the European Union's member states

The answer can be found at the bottom of the page.

Business in Brief

Everything you need to know

1. Shadow chancellor Rachel Reeves would seek to break down EU trade barriers and secure billions of pounds through an early international investment summit if Labour wins the general election. In an interview with the Financial Times, Reeves also said Labour would take risks and was willing to “upset some people” to unlock the potential of the British economy. You can read more here.

2. London has regained its crown as Europe’s biggest stock market, just two years after losing the status to Paris. French stocks have suffered from the shock election called by president Emmanuel Macron last week, which hit bank shares in particular. Read more here.

3. UK manufacturers are expecting a boost in the second half of 2024, according to a survey from Make UK. The survey foresees growth in the sector but warns the next government must tackle the skills shortage. You can read more here.

4. The period of post-Covid “revenge spending” has ended, according to the chief operating officer of Merlin Entertainments. The term was coined to describe how people splashed the cash after the Covid pandemic to make up for time lost to lockdowns. As a result, many UK attractions are having to come up with new tactics to win back visitors. Find out more here.

5. Hiring for seasonal summer jobs has fallen sharply as employers grapple with rising wage costs, according to new figures from the Recruitment and Employment Confederation. The rise in the minimum wage is piling pressure on employers, which are cutting back on hiring this summer amid broader fears of labour shortages in key sectors of the economy. You can read more here.

Business Quotes

Inspiration from leaders

"The road to success, for 99 per cent of people, isn’t a jump. It’s a steady incline from one successful project to the next."

- Lee Morris

Business Thinker

Ideas on the future of business and leadership

1. ? How to get results quickly after a merger or acquisition ?

2. ? A killer golf swing is a hot job skill now ?

3. ?? Surgeon General calls for warning labels on social media platforms ??

And finally...

Football fever is well and truly gripping Europe at the moment, but a footballing headline over the weekend holds a key lesson for business leaders.

Fabian Hürzeler has been appointed as the manager of Brighton & Hove Albion... at the age of just 31. On Friday, a 36-year-old head coach oversaw the 5-1 demolition of Scotland and the Boston Celtics are one win away from their first title since 2008... with a 35-year-old coach.

The Times has done a fantastic deep dive into why young coaches are doing so well. Here's an extract:

"Here may be another key to the success of this new generation of young coaches: modern communication skills.

This is [Jonathan] Harding again: 'The opening of the conversation about vulnerability and mental health has triggered a seismic shift in the way managers communicate.' And: 'Modern coaching is heading in this direction and it is harder for older people to connect with younger people."

Food for thought indeed. You can read the full article here.

The answer to today's Business Question is 2002.

Related and recommended

Communications specialist Tom Laranjo shares advice on how to integrate artificial technology into the workplace

Video games entrepreneur Gina Jackson explains a common trap developers can fall into when making games

Mastering emotional intelligence can help you make better decisions, navigate conflict and build a workplace people want to be part of

Both the country and the government must face the truth: either taxes will have to rise or services will need to be cut. We can’t have both