This article is an online version of our Off to Lunch newsletter. Sign up to receive it straight to your inbox here.

By Sarah Vizard

Many of us may have been distracted by a brilliant weekend of sport in which we witnessed the closest men's 100-metre race in history, a first-ever Olympic medal in the women’s 100 metres for St Lucia and an epic battle between Novak Djokovic and Carlos Alcaraz for gold in the men’s tennis.

But for many that distraction won’t have lasted long this morning. Global stock markets have fallen sharply today, with investors rattled by concerns of a US recession and a worsening situation in the Middle East.

Japan’s benchmark stock index the Nikkei 225 fell by 13 per cent – its worst performance since “Black Monday” 37 years ago and wiping out all its gains this year. This was echoed in other Asian markets, with South Korea’s Kopsi dropping by 9 per cent, while stock markets in India, Hong Kong, China and Australia also fell.

In the UK, the FTSE 100 fell by 2 per cent and is having its worst day in more than a year. Nearly all the companies on the index dropped as markets opened, with just five higher in early trading. The benchmark Stoxx Europe 600 shed 3 per cent of its value.

There are indications that stocks in the US will follow suit when markets open there. The S&P 500 is expected to open around 2.9 per cent lower, while contracts tracking the Nasdaq 100 are trading down 5 per cent, according to the Financial Times.

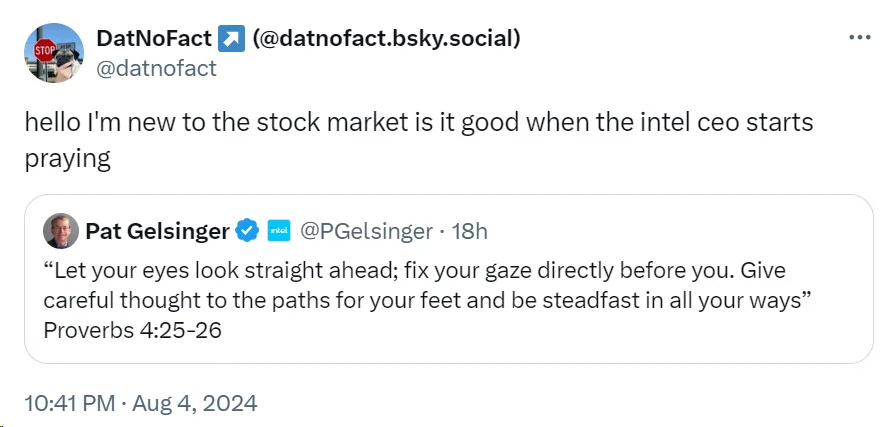

That follows losses for Wall Street on Friday, when tech firms were particularly hit as investors pulled back from a rally fuelled by optimism over AI. Amazon shares fell by more than 9 per cent on the back of weaker-than-expected revenues, one of the biggest one-day falls for the company in recent history. But it was worse for Intel, which dropped by more than a quarter, its biggest one-day fall since 1982, seemingly prompting this tweet from its CEO:

Warren Buffett’s Berkshire Hathaway has more than halved its stake in Apple, despite the company posting record quarterly operating profit. Berkshire sold roughly 390 million Apple shares in the second quarter and 115 million in the first as part of a broader move away from stock and towards cash that suggests Buffett is wary about the state of the US economy and the price of stock market valuations. Apple shares are forecast to open about 9 per cent down when trading begins in New York this afternoon. That would be equivalent to $30bn (£24bn) being wiped off the value of the company.

While the AI pullback is one explanation for the slump, there are wider issues at play. Rising tensions in the Middle East have investors worried, as have signs of a weakening economy in the US. Just 114,000 new jobs were added in the US last month, lower than expected and well down from June, while the unemployment rate hit its highest level since October 2021.

The economic turbulence is also impacting M&A. Sidara, a Dubai-based company, has decided not to buy British engineering group John Wood, citing rising geopolitical risks and financial market uncertainty. The Middle East is a key area of growth for John Wood, accounting for around 18 per cent of its business. Shares in the firm fell by 40 per cent on the news.

While stock markets are falling, analysts seem less concerned. Goldman Sachs said in a note to clients seen by Bloomberg News that it believes the chances of a US recession have risen from 15 per cent to 25 per cent, although it caveats that it sees the risk as “limited”.

Meanwhile, Jim Reid, global head of macro research at Deutsche Bank, called the moves “astonishing” and “profound” but added: “It’s like the market has added up two plus two and made nine.”

Nevertheless, it makes interest rate reductions more likely. The US central bank held rates at its meeting last week, but signalled cuts are likely in the coming months. Finding the right balance to get economies moving again is proving tricky.

Business Agenda

A summary of the most important business news

1. Intel is in danger of becoming a new case study about how a great business can unravel. Shares in the company have fallen by more than 50 per cent in 2024 and there could be worse to come. The chipmaker is under pressure from a string of nimble rivals such as TSMC, Nvidia and Arm, whose innovations have eroded Intel’s market. You can read two interesting pieces on the challenges facing Intel from The Economist here and the Noahpinon newsletter here.

2. The best high street in the UK is Queen Street in Cardiff according to a survey of more than 2,000 people by American Express and Global Data. The reason? Its location next to the station, views of Cardiff Castle and only two empty shops. You can read more here.

3. A sandwich business founded in Bristol in 2010 by a self-taught chef is planning to expand to London. Sandwich Sandwich is run by Nick Kleiner and his son Josh and has emerged as a rival to Pret A Manager. More from Business Live here.

4. An alcohol-free bar in Manchester is to close after less than a year. Karl Considine, the founder of Love From, told The Times: “I think there is some novelty in what we do. We had regulars but a lot of people will just try it once.” You can read more here.

5. Lloyds Banking Group has hired Rohit Dhawan from Amazon to be the bank’s first group director for AI and advanced analytics. Dhawan was head of data and AI strategy for Amazon Web Services, Amazon’s cloud-computing business, in Asia-Pacific. Dhawan will be responsible for shaping the “overall AI, machine learning and advanced analytics strategy, driving technical excellence, and promoting the adoption of AI-enabled products and services to enhance and transform the experience for the group’s 27 million customers”. More from Lloyds here.

Business Question

Who am I?

- I founded my company with my husband in 1984

- Our first store was in Guernsey and today I see we have over 950 stores

- I was made a Dame in 2007

- I am 105 on the Sunday Times Rich List and joint 32 on the Business Leader Great British Billion-Pound Businesses list

The answer can be found at the bottom of the page.

Business Thinker

Deep dives on business and leadership

?? Is UK productivity low because of poor governance?

A recent paper suggests that poor governance practices in unlisted companies may be contributing to low productivity in the UK. The study found that companies with poor management practices often operate in low-competition areas and are prevalent among family-owned businesses, particularly when control is overly concentrated within the family. Investment strategist Joachim Klement breaks it down.

?? Why are there so many fast-food offers on?

Fast-food giants are intensifying their promotional offers as they compete to attract more thrifty customers. With the number of promotions rising by a third between April and June compared to the previous year, chains like McDonald's, KFC and Domino's are using deals to counteract declining foot traffic and rising costs. We may be watching a pivot masterclass that growing businesses can learn from.

?? How I turned LADbible into a £260m media empire

The Sunday Times has spoken to Alexander “Solly” Solomou, the 33-year-old CEO of LBG Media, about how he transformed LADbible from a controversial Facebook page into a £260m business with 500 employees across Manchester, London and New York. Despite challenges in the digital media landscape, LBG Media is thriving, leveraging its vast social media presence and adapting to changing algorithms and audience preferences.

Business Quote

Inspiration from leaders

“A good leader takes a little more than his share of the blame, a little less than his share of the credit.”

– Arnold Glasow

Business Leader

The best of our content

The 3Ps that provide the key to long-term motivation

Venus and Serena Williams, tennis legends with over 122 professional titles combined, have sustained their motivation over careers spanning decades. How have they maintained such drive?

This article from our expert on sustaining performance, Catherine Baker, delves into the factors that fuel their enduring success and the lessons they offer for leadership and business.

By focusing on the three Ps, both elite athletes and business leaders can cultivate sustained motivation and overcome setbacks. Explore how these principles can transform your approach to long-term performance and resilience.

You can read the article here.

Other popular pieces

?? McDonald’s, Nike and Starbucks show the perils of losing sight of the customer

? Sorry, but Brits need to stop apologising and love success

?? PureGym’s CEO on why leaders need a sense of healthy paranoia

And finally...

The Voyager 2 spacecraft is the furthest away human-made object from our planet. Launched in 1977, just weeks after Voyager 1, it is now 15.2 billion miles away and getting 10 miles further away every second.

Their initial mission was to tour the giant outer planets of Jupiter, Saturn, Uranus, and Neptune, photographing them and collecting data. But when that tour was finished, they just kept going.

In case they are ever found by another lifeform, each has an aluminium phonograph record that contains images of our DNA, greetings in 55 languages, the sounds of animals and machines, and the music of Beethoven, Louis Armstrong and Blind Willie Johnson.

But Voyager 1 has now broken. And nobody can remember how to fix it. This fascinating deep dive from the Financial Times tells the story of the spacecraft and how engineers and scientists have worked together to try to remember how to fix it, digging through archives and coming up with new solutions.

You can read it here.

The answer to today's Business Question is Mary Perkins.

Related and recommended

Will Orr shares his insights into Gen Z’s changing attitude to health and fitness

Both the country and the government must face the truth: either taxes will have to rise or services will need to be cut. We can’t have both

The prime minister is seeing his popularity – and his authority – fade as a series of costly U-turns make tax rises ever more likely

Eric Johnson leads an online platform focused on the value of collecting feedback, a principle he applies to his own company