Entering 2023 marks a decade of progress in the cultured meat industry. Ten years ago, the world was introduced to the first lab-grown burger, and this year, it is possible that American consumers will have the opportunity to taste this revolutionary food for themselves.

The end of 2022 saw a major milestone for the industry, with the Food and Drug Administration (FDA) approving a cultured meat product for the first time, a significant step towards commercialisation.

To gain a deeper understanding of the state of the cultured meat industry and its future opportunities, IDTechEx has recently published the report “Cultured Meat 2023-2043”. This report provides an in-depth technology and market evaluation of the cultured meat industry based on extensive primary research into the sector, including interviews with key players.

The report discusses the global meat industry and drivers for cultured meat adoption, the chemical and physical make-up of meat, the process of making cultured meat, the current state of the cultured meat industry, and the regulations governing it, alongside profiles of players in the industry.

It contains historic market data from 2021 and market forecasts from 2023 to 2043, segmented into five geographic markets. In this report, IDTechEx predicts that the global cultured meat market will be worth $2.1bn (£1.8bn) by 2033 and $13.7bn (£12bn) by 2043.

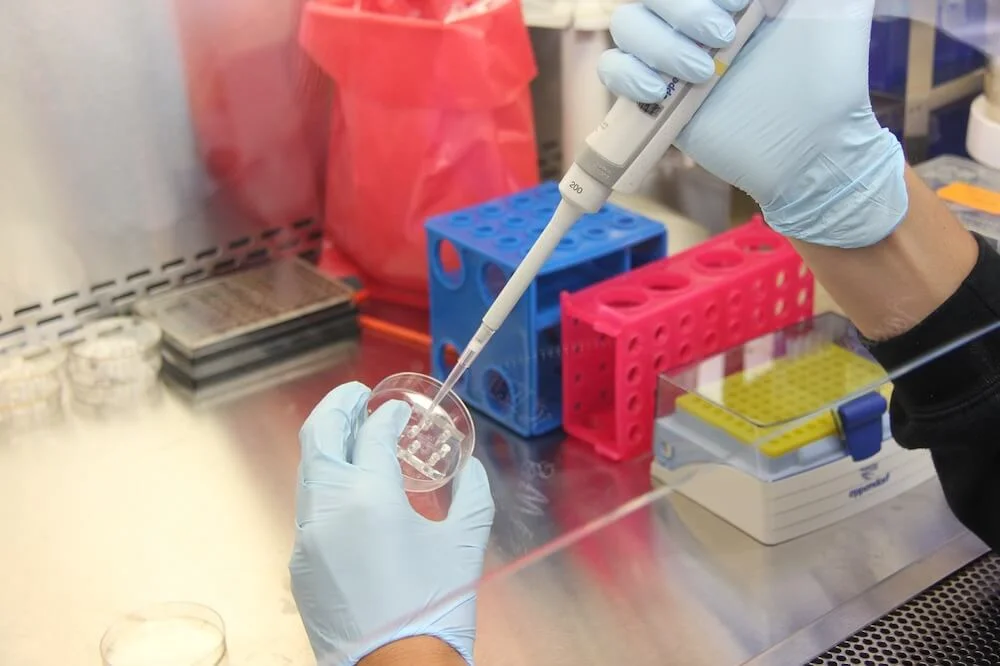

Cultured meat, otherwise known as cultivated or lab-grown meat, is an emerging technology area that uses animal cells grown in the lab to create meat products without requiring animal slaughter and with the potential to improve the sustainability of meat.

Unlike many of today’s plant-based meat alternatives, cultured meat technology has the potential to create products identical to conventional meat, comprising the same fat and muscle tissue.

Cultured meat has been rapidly growing as a new market over the last few years. Within less than a decade, the industry has grown from a handful of start-ups to over 80 companies across the cultured meat value chain.

In November 2022, UPSIDE Foods received pre-market approval from the Food and Drug Administration (FDA), the United States’ regulatory body for cultured meat. This was the first time a major market had approved a cultured meat product, a key step that demonstrates the viability of this industry and paves the way to commercialisation.

This approval follows the precedent set in the Singapore market, where Eat Just’s ‘GOOD Meat’ product was approved in 2020. With these promising signals from regulatory bodies, the cultured meat industry is poised for rapid scaling and the introduction of numerous commercial products in the coming years.

One indicator of growing interest in the cultured meat industry is the rising investments in this space. Investments have risen from $250,000 (£202.950) in 2015 to $800m (£703.3m) in 2022, a sign that investors believe in the potential of the cultured meat industry.

Related and recommended

Contestants from The Apprentice reveal the fundamental business lessons they learned from taking part in the TV show

From global talent pools to AI-powered documentation, a work-from-anywhere model is a new way of thinking about productivity, innovation and teamwork

The story of how cycling brought Business Leader member John Readman together with his co-founder and investors

Stuart Machin’s hands-on leadership has revived M&S, tripling its share price and reshaping its future, by obsessing over the details, from shop floors to staff message boards