A look inside vinyl’s resurgence

Vinyl sales have been rising fast and new technology, including on-demand manufacturing, suggest its growth still has some way to go

Last year, vinyl record sales hit their highest point since 1990. Vinyl’s resurgence also helped HMV more than double its profits. But will it last?

The rise of vinyl

According to the British Phonographic Industry (BPI), the trade association for Britain’s recorded music industry, vinyl LP sales grew 11.7 per cent in 2023, marking the 16th consecutive year that they increased. From 2014 to 2023, sales increased from just under 1.3 million to more than 6.1 million.

Pre-tax profits at HMV’s owner Sunrise Records & Entertainment also more than doubled from £2million to £5.3million during the year to May 2023, with sales rising from £151million to £178million.

“Sales growth is representative of the continued revival of vinyl but also of our expanded pop-culture, anime and K-pop offerings, which have growing fan bases amongst younger audiences,” said HMV owner Doug Putman. The music and entertainment retailer claims it accounts for more than half of vinyl sales in the country in some weeks.

Mario Forsyth is the commercial director of Proper Music Group, which provides everything from global music distribution to artist and label services, publishing, and direct-to-consumer (D2C). For him, retailers have played a huge role in vinyl’s reemergence.

“Historically, you went into a record shop, had a browse or knew what you wanted, made the purchase and left,” he explains. “With the emergence of stores like Rough Trade, you had that experience but then retailers would make recommendations for other albums and mention live store performances or artist signings. Now, stores are hosting sessions for people to sit down, listen to an album and they’ll serve wine, so it becomes this really good experience.”

Digital complements physical

While interest in owning physical music has grown, more people are streaming than ever before. According to the BPI, streaming was up 12.8 per cent in 2023, taking the yearly total to 176.6 billion audio streams. This means it now accounts for 87.7 per cent of recorded music consumption in the UK, up from 63.6 per cent in 2018.

Gennaro Castaldo, the BPI’s director of communications, believes listening to vinyl is complementary to streaming. “Back in the noughties, you had the rise of downloads and consumers made a choice between buying the download or the physical product,” he says. “But because streaming is essentially a subscription, it’s not inconsistent with the idea that when you come across a record or artist that you love, you will want to buy it for your collection.”

“There’s a lot of talk in the music industry about the superfan,” says Forsyth. “They can stream, go to gigs, and buy tickets via the artist’s website. They just want to be closer to the artist and as that superfan market continues to grow, vinyl will play a huge part.” You can now buy physical products directly from streaming platforms, he adds.

New distribution models

Physical music sales have been supported by increased distribution capacity. In August last year, global supply chain solutions provider DP World and Utopia Distribution Services (UDS) teamed up to open the UK’s largest distribution warehouse for physical music and video, which will reportedly handle 70 per cent of physical music products sold in the UK.

Like Proper Music Group, UDS is owned by Utopia Music and operations there fall under Forsyth’s remit. He says: “As well as servicing the B2B, our traditional boxes to retailer market, we’re servicing the D2C market. So, instead of sending items to retailers, we will dispatch them directly to consumers. That is the next growth area we’re expecting from a distribution service.”

However, an insider at a vinyl pressing plant told us the number of records they produced declined last year. They believe one reason for the downturn is the US increasing its manufacturing capacity. “The US relied heavily on large European plants to manufacture their home needs, but this has changed drastically over the past couple of years with large capacity being installed not only in the US but Canada and Mexico,” they said. The high stockholding of titles manufactured in 2022 making their way through the tills was another factor.

Looking ahead

The New Statesman reported there was a potential unfilled demand of 200 million for vinyl records in 2021, when there were fewer than 100 vinyl pressing plants worldwide. However, the insider said reports suggest there are now over 200.

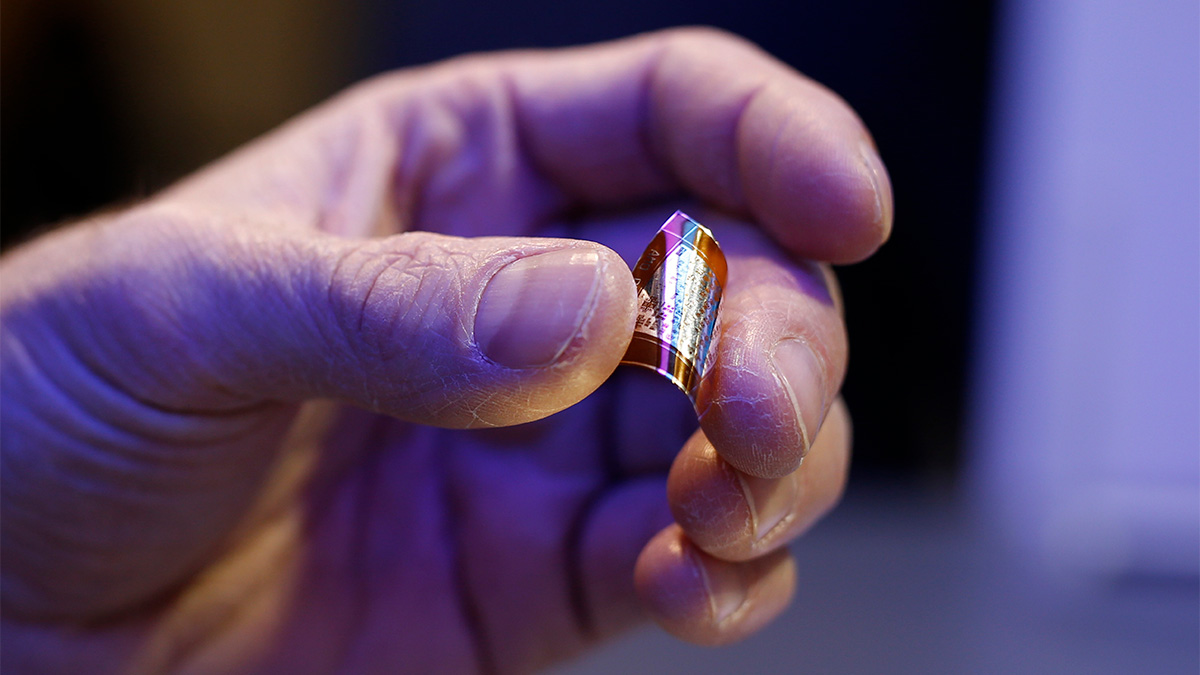

Disruption is on the horizon thanks to platforms like elasticStage, billed as the world’s first on-demand vinyl manufacturer, which is set to launch this year. According to CEO Steve Rhodes, 99.9 per cent of roughly 30 million artists who publish music on the internet to try and sell it are currently unable to sell vinyl records because traditional pressing plants are designed for people who sell millions of them. It costs roughly £2,000 to make just 250 records, plus newer artists require someone to distribute them.

However, elasticStage allows users to create a record online with no upfront cost or minimum order size and sell it directly to consumers through their platform. “There will be 150 million people who will probably sell two or three records a year by 2030,” says Rhodes. “That’s a gigantic market and makes us a multi-billion-pound company right there.”

Considering the number of record sales so far, Castaldo is anticipating growth of around 7 or 8 per cent in 2024. However, this depends on what records are brought out. He says, “Taylor Swift put out new releases at the end of last year, so it would need an artist of comparable size releasing records.”

Seven of the 10 most popular vinyl LPs in 2023 were new releases, with Taylor Swift’s 1989 (Taylor’s Version) and Speak Now (Taylor’s Version) leading the way. However, after winning Album of the Year at the Grammy Awards, Swift announced her next album will be released in April this year. “When we’ve spoken to record shops, they’ve told us Taylor Swift acts as a key point of discovery for customers coming in to buy her albums,” says Forsyth. “That leads them on a journey of discovery for other artists and a deepening of their vinyl catalogue.”

But with Fleetwood Mac’s Rumours and Pink Floyd’s The Dark Side of the Moon also featuring in the top 10, it’s not just new releases consumers are buying.

Putnam said the second half of 2023 was more challenging for HMV due to the cost-of-living crisis and bad weather. Forsyth believes the cost-of-living crisis is something to be mindful of, but says the market is slightly up in 2023, which bodes well for the year ahead.