Spring Budget 2024: What it means for business

There wasn't much new in the budget but measures on national insurance, child benefits and tax rises were broadly welcomed

[Image credit: Peter Nicholls/Getty Images]

[Image credit: Peter Nicholls/Getty Images]

Let’s start with the most important things – Jeremy Hunt really upped his social media game ahead of the Budget. We got a sneak peek of the chancellor working behind the scenes and even a video of him watching old speeches…

But Hunt’s enthusiasm for the Budget was not necessarily matched by others, such as political analyst Sam Freedman, who is not a fan of the event…

And Freedman was not alone. Torsten Bell, the chief executive of the Resolution Foundation, the think tank, also seems to have run out of patience with the Budget. This is despite the fact that his job actually revolves around analysing the government’s economic policies. These were some of his tweets during the Budget…

One of the reasons for this frustration is that there just wasn’t much new in the Budget. Most of the policies had been leaked to the media or openly discussed in advance. There was no rabbit out of the hat.

However, there were jokes about the Laffer curve and how Keir Starmer needs to lose weight but if Labour gets into power then families “will shed more than a few pounds”. Yes, this really happened…

Another joke about tax and multiple homes seemed to go down badly with Angela Rayner, Labour’s deputy leader…

Anyway, let’s now look at the policies that were actually announced. Despite the commentary above, there were significant measures.

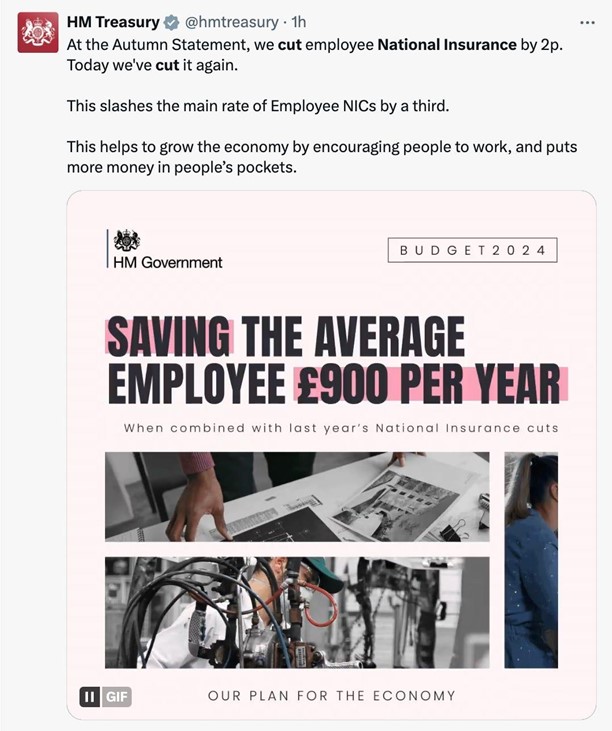

Hunt announced in the speech that national insurance will be cut by 2p from April. This means a cut from 10 per cent to 8 per cent for those in jobs and from 8 per cent to 6 per cent for the self-employed. This could encourage another 200,000 into work and add 0.4 per cent to GDP per head, according to forecasts from the Office for Budget Responsibility.

Hunt also said that child benefits will be expanded, providing another tax break. The threshold for a parent to qualify for these benefits will be increased from an annual income below £50,000 to an annual income of £60,000, with the benefits tapering off before stopping for those who make £80,000 or more.

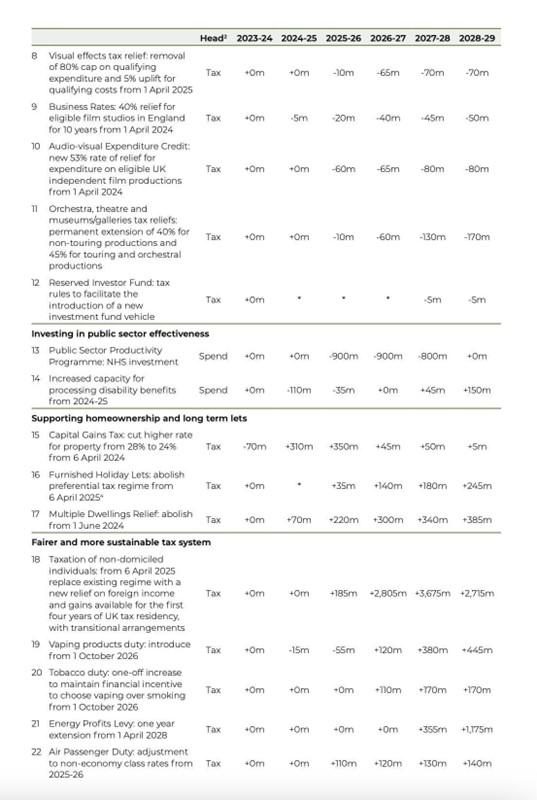

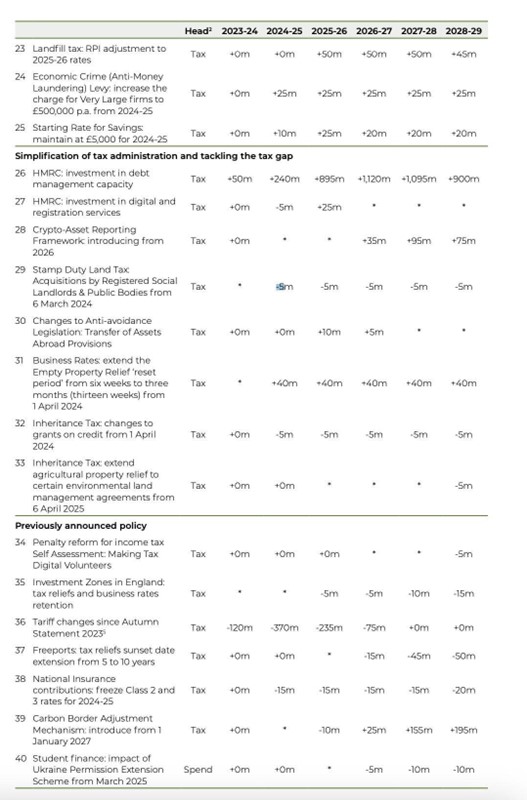

But there was also a series of tax rises. These include:

-The abolishment of the non-dom tax status in favour of new residency rules. These new rules will eventually bring in at least £2.7billion in extra tax every year for the government, according to forecasts.

-Air passenger duty will be increased on non-economy flights (ie business travel)

-Tax relief has been scrapped on furnished holiday lettings

-Stamp duty relief will be removed on buying more than one property in a transaction

-There will be a new tax on vaping from 2026 and an increase in tobacco duty

-The windfall tax on North Sea oil and gas has been extended for a year

And here is a round-up of the other announcements that were made:

-Public spending will increase by 1 per cent in real terms over the next five years (as per the government’s previous plans) but the chancellor said the public sector must “spend it better” and announced a new productivity plan. The NHS will get a £2.5billion top-up to its spending this year

-Alcohol and fuel duty have been frozen for another year

-The threshold for businesses to pay VAT has increased from annual revenues of £85,000 to £90,000

-There will be a new British ISA to encourage people to invest in UK assets. This will allow an extra £5,000 of investment in UK assets on top of the current £20,000 allowance

-There will be a collection of tax breaks for film and television studies, including a 40 per cent discount on business rates

-AstraZeneca is to invest £650million in a new vaccine factory in Merseyside and expanding its presence in Cambridge

-The government has agreed to pay £160million to Hitachi for sites in Wales and Gloucestershire that could be nuclear power stations

The general consensus among those in the know was that the Budget did not suggest that Rishi Sunak could call an election in May…

Although there was this…

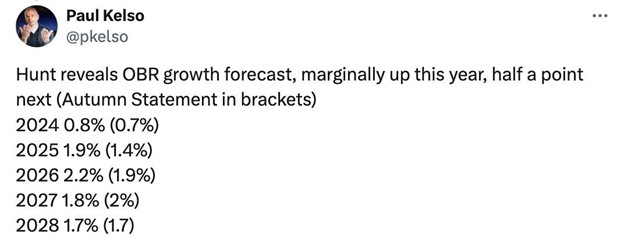

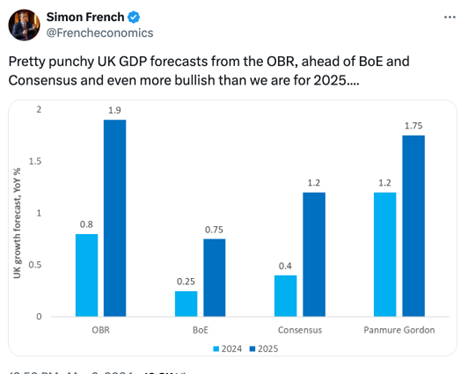

Alongside the Budget, the Office for Budget Responsibility, the government’s spending watchdog, has published its latest forecast on the economy.

These forecasts are more optimistic than the OBR’s previous forecasts in November. The first post below shows the OBR’s forecast for economic growth relative to their previous forecast (that’s Paul Kelso’s post) and the second shows them relative to other organisations (Simon French)…

The OBR is also forecasting that inflation will fall below 2 per cent this year. “We have turned the corner on inflation and we will soon turn the corner on growth,” the chancellor said

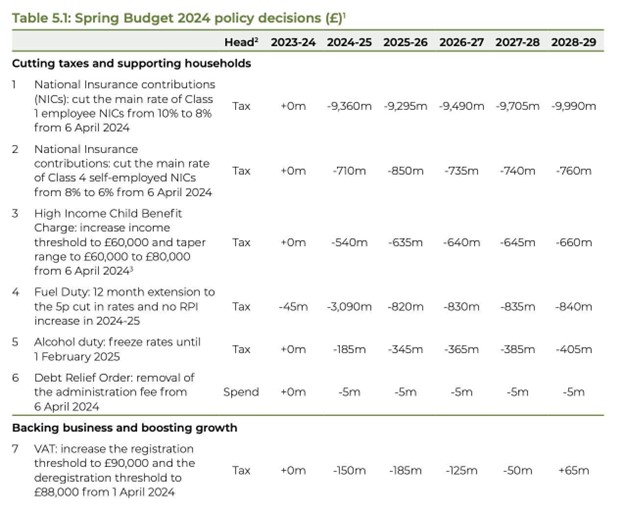

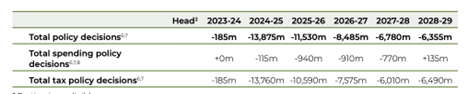

Finally, I want to show you the tables from the official Budget document that highlight the importance of the policies and how much they will save or cost. The numbers below show the impact of each policy on the government’s finances every year. As you can see, the national insurance cut is a significant move and will save taxpayers more than £9 billion every year….

For those interested in further reading, you can find the Budget document here and the OBR’s analysis here.

This is an extract from Business Leader’s daily newsletter Off to Lunch. To receive it directly in your inbox please click here.