Inflation falls back but the cost-of-living crisis isn’t over yet

Plus, Nvidia becomes the world's most valuable company, smaller companies are increasingly appointing all-male boards and Hargreaves Lansdown on the verge of a takeover

This article is an online version of our Off to Lunch newsletter. Sign up to receive it straight to your inbox here.

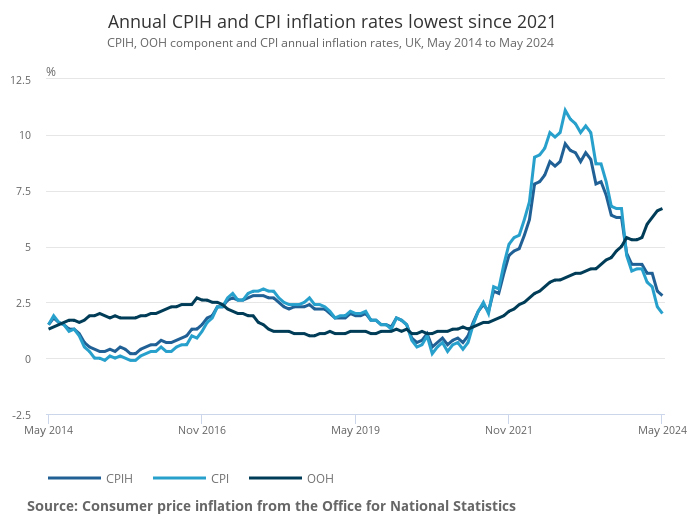

Inflation has hit the Bank of England’s target of 2 per cent for the first time in almost three years, down from 2.3 per cent the previous month. Data from the Office for National Statistics shows the figure was driven down by the price of products including food and non-alcoholic drinks, transport and furniture.

The inflation rate is a key metric for the economy and has been one of the main talking points among politicians in the run-up to the general election. All the main parties are discussing how they would keep the cost of living under control following the worst inflationary period since the 1980s.

Rishi Sunak has already pledged further tax cuts, telling LBC that the inflation rate falling to its target rate means this is now possible. “It is because of that economic stability that we have restored, which was my priority when I got this job, that we have now been able to start cutting people’s taxes. If I win this election, I want to keep doing more of that.”

However, shadow chancellor Rachel Reeves says people are still “worse off”. She says: “Prices have risen in the shops, mortgage bills are higher and taxes are at a 70-year high.”

The inflation rate reached a high of 11.1 per cent in October 2022 and hasn’t hit its target since July 2021. The increases have led to the Bank of England putting interest rates up to 5.25 per cent, their highest levels since 2008.

Despite the slowdown in the inflation rate, both consumers and businesses are still feeling the effects of the big rises in the price of goods and services. Prices on average have increased by almost 18 per cent since July 2021, while food prices are up by almost a quarter.

That means the cost of a meal that was priced at £12 three years ago is now £15, while a sofa that cost £600 is now £706. With mortgage, energy and fuel costs also much higher than three years ago, many still face difficulties with the cost of living that the next government will need to tackle.

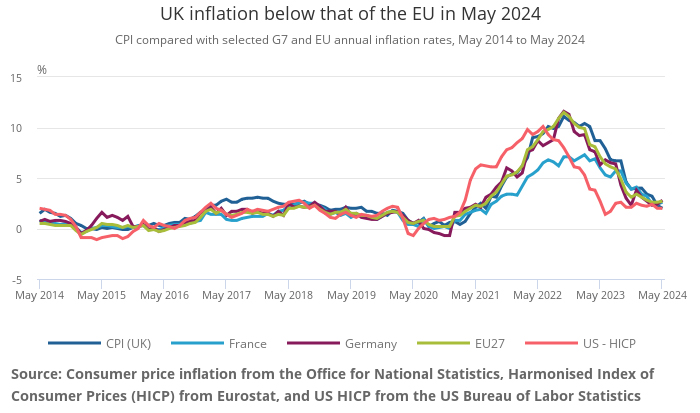

The UK is not alone in seeing big price rises as global economies struggled with costs amid the Russian invasion of Ukraine and the impact of the Covid-19 pandemic. The inflation rate in France and Germany and across the EU 27 hit similar highs to the UK and have been coming down at a similar rate, although has not yet hit the target of 2 per cent.

The US’s inflation rate, when using HICP which excludes housing costs, never quite hit the highs of Europe and has fallen faster. It reached 1.4 per cent in June 2023 but has since inched back up.

The Bank of England is set to make its latest decision on the UK’s interest rate tomorrow (20 June). Despite the inflation rate hitting its target, the bank is not expected to cut interest rates due to concerns that prices could tick up again in the second half of the year.

Price rises in the services sector are also still high, at 5.9 per cent, while the core inflation rate, which excludes food, energy, alcohol and tobacco, is still at 3.9 per cent.

Business Question

Guess the company

- Its roots go back to 1812

- It has over 21,000 employees and 10.3 million customers

- It is a FTSE 100 company

- Its CEO was CFO before stepping into the top job

- It bought The AA in 1999 before selling it in 2004 for £1.75bn

The answer can be found at the bottom of the page.

Business in Brief

Everything you need to know

1. Nvidia has become the most valuable company in the world after its share price climbed to a record high of $136 (£107). That share price means the company is now valued at $3.34tn (£2.62tn), putting it ahead of both Microsoft and Apple. Many expect its value to rise still further as demand for the AI chips it manufactures soars. You can read more here.

2. The Bristol-based investment fund Hargreaves Lansdown will accept a proposed offer for the business from the private equity firms CVC, Nordic Capital and a subsidiary of the Abu Dhabi Investment Authority. The offer is worth £11.40 a share and values the company at £5.4bn. The bidders have until 5pm today to make a firm offer. If it goes ahead, it would see Hargraves Lansdown become the latest in a growing list of firms to leave the FTSE 100. You can read more here.

3. Starling Bank has filed winding-up petitions against 24 companies that have defaulted on loans, most of which have shown few signs of active trading and three of which have never filed accounts. The analysis by the Financial Times raises questions about the companies it lends to. It comes as the fintech flagged a spike in defaults and revealed it is under investigation over its financial crime controls by the FCA. You can read more here.

4. Smaller listed companies are increasingly putting all-male boards in place, according to analysis by WB Directors. It found that the number of AIM-listed companies with no women on the board jumped by 73 per cent to 187. On the FTSE 100, all-male boards have disappeared and they are rare at other large listed companies. You can read more here.

5. Sir George Iacobescu, one of the key people behind the rise of Canary Wharf, is to step down as chairman of the board of directors. Iacobescu first started working at the Wharf in 1988 for then-developer Olympia & York; he became CEO of the Canary Wharf Group in 1997. He will hand over the chairman role to Sir Nigel Wilson, previously CEO at Legal & General. You can read more here.

Business Quotes

Inspiration from leaders

“One voice can change a room.”

– Barack Obama

Business Thinker

Ideas on the future of business and leadership

1. 🏠 Invested in the WFH argument? Home in on the evidence 🏠

2. 🌱 Britain needs to grow again 🌱

3. 🖋️ Why Bic, the maker of pens and shaving sticks, believes it’s a tech company 🖋️

And finally…

Christie Aschwanden is certain about uncertainty. The author and journalist hosts the Scientific American podcast called Uncertain, which is all about uncertainty in science.

The podcast series itself is well worth a listen. It offers five episodes including practical advice on how to sit with uncertainty, how to avoid being overconfident and why uncertainty is a superpower. It’s ostensibly about science but it has applications across business.

The thing that caught the attention of the Business Leader editorial team this week, though, is her interview with fellow journalist David Epstein. On his Substack, they discuss the viral dress phenomenon and why people were so certain they could see either gold and white or blue and black, and the problem with assumptions.

As Aschwanden says: “One of the reasons I made this podcast was to help people understand that science is a process, and we need to be careful to remember that it’s always provisional and open to updating. As the evidence accumulates, we can greatly reduce the uncertainty, but it never goes to zero. We should be careful about putting too much stock in any single study.”

A lesson we can all learn from.

The answer to today’s Business Question is Centrica.