Revolut banking licence: A fintech milestone

Plus, the value of M&A is up by two-thirds, why we might be able to say goodbye to the office birthday party and an Olympics preview in today's Off To Lunch

This article is an online version of our Off to Lunch newsletter. Sign up to receive it straight to your inbox here.

Revolut has secured a UK banking licence, albeit one with “restrictions”, more than three years after it lodged an application with regulators.

The news is a milestone for the company, which faced difficulties convincing regulators it should be given a licence after a number of accounting and reputational issues. The firm has delayed filing of accounts, breached EU regulations and been the subject of allegations over its working environment.

Nevertheless, the company is a darling of the UK fintech scene. It is Britain’s most valuable fintech, most recently valued at £14bn, although its valuation has fluctuated a lot in the past few years. Nikolay Storonsky and Revolut are in third position on our Great British Billion-Pound Businesses list, which was published in the July/August issue of Business Leader.

Storonsky, who was born in Russia but came to the UK when he was 20, set up Revolut in 2015. Its app-based payments service undercuts mainstream banks with services such as fee-free foreign exchange. It now operates across 160 countries and has more than 45 million customers. Our list valued the company at £14bn, but a secondary-share sale could value the firm at a figure as high as $45bn (£35bn), according to the Wall Street Journal.

The UK licence will allow the company to hold customer deposits, meaning it can offer own-brand loans and mortgages. That is a key step in its aim to move from being an intermediary between consumers and licensed banks to a bank in its own right.

It will also help its growth. The company had a licence in Europe from the Bank of Lithuania but its lack of full authorisation was a brake on its growth ambitions, both in the UK and overseas. Approval from UK regulators makes it more likely that regulators in other markets, particularly the US, will follow suit.

The company generated £1.8bn in revenues last year and was profitable, delivering a pre-tax profit of £437.8m.

Storonsky says: “We are incredibly proud to reach this important milestone in the journey of the company and we will ensure we deliver on making Revolut the bank of choice for UK customers.”

Now that it has secured a licence, it can start what is termed mobilisation, meaning it will invest in building the systems needed to operate under a full licence and address any issues identified by the regulator. This process usually takes new banks around a year to go through.

Revolut is one of a wave of fintech firms that have received a banking licence since 2013. Some 37 “start-up” banks have been authorised by the Prudential Regulation Authority since 2013, including Monzo Bank, OakNorth Bank, Atom Bank and Starling Bank.

These fintechs have been taking on the incumbents in the industry across sectors as diverse as business finance, current accounts, mortgages and loans. More than two-thirds (36 per cent) had a digital-only bank account in 2024, up from 24 per cent at the start of 2023, according to data from Finder.

Business Question

Who am I?

- I co-founded a business lender in 2010 and served as CEO until 2021

- It was originally set up as a peer-to-peer lending marketplace and listed on the LSE in 2018

- I was awarded a CBE in 2015

- I founded an online payments fintech in 2022

The answer can be found at the bottom of the page.

Business in Brief

Everything you need to know today

1. The value of M&A in the UK increased by nearly two-thirds in the first half of the year as corporate buyers’ appetite for bigger deals increased. Data from PwC shows that the value of M&A deals reached £68bn, up from £41bn in the first half of 2023. This was largely due to a handful of big deals: there were 16 deals worth more than £1bn, compared to seven in 2023. You can read more here.

2. Unilever’s second quarter sales growth missed estimates as consumer groups struggle amid the ongoing cost-of-living crisis. Underlying sales at the company, which owns brands including Dove and Magnum, were up by 3.9 per cent. Analysts were expecting growth of 4.2 per cent. It raised prices by just 1 per cent, below expectations of 1.6 per cent rises. Nestle also struggled to raise prices, putting through increases of 2 per cent versus the 3 per cent expected. You can read more here.

3. UK ad spend increased by 9.3 per cent to £9.2bn in the first three months of the year – a new high for the first quarter. Data from the Advertising Association and Warc showed stronger-than-expected growth in online spend, with digital formats now accounting for 79.7 per cent of all ad spend in the quarter. It now expects UK ad spend to grow by 7.7 per cent this year to reach £39.4bn. You can read more here.

4. Improbable, the deeptech unicorn valued at £2.7bn according to our Great British Billion-Pound Business list, has turned its first profit after a difficult period for the company that led to it making layoffs and selling parts of the business. It made a pre-tax profit of £13m in 2023, according to financial results shared with Sifted. Revenues fell by 15 per cent to £66m but the sale of its defence and multiplayer games businesses meant it made it into the black. You can read more here.

5. Crowdstrike, the company behind the global IT outage last week, is giving out $10 (£7.80) in vouchers to say sorry – some of which don’t work. A screenshot of an email sent to staff recognised their “additional work” and offered “heartful thanks and apologies for the inconvenience”. But some recipients said they didn’t work. You can read more here.

Business Quotes

Inspiration from leaders

“Whether you think you can or think you can’t – you are right.”

– Henry Ford

Business Thinker

Ideas on the future of business and leadership

1. ? Why OpenAI may well be completely Zuck’d ?

2. ? Say goodbye to the office birthday party (thank goodness) ?

3. ♨️ Businesses are counting the likely cost of ‘heatflation’ ♨️

And finally…

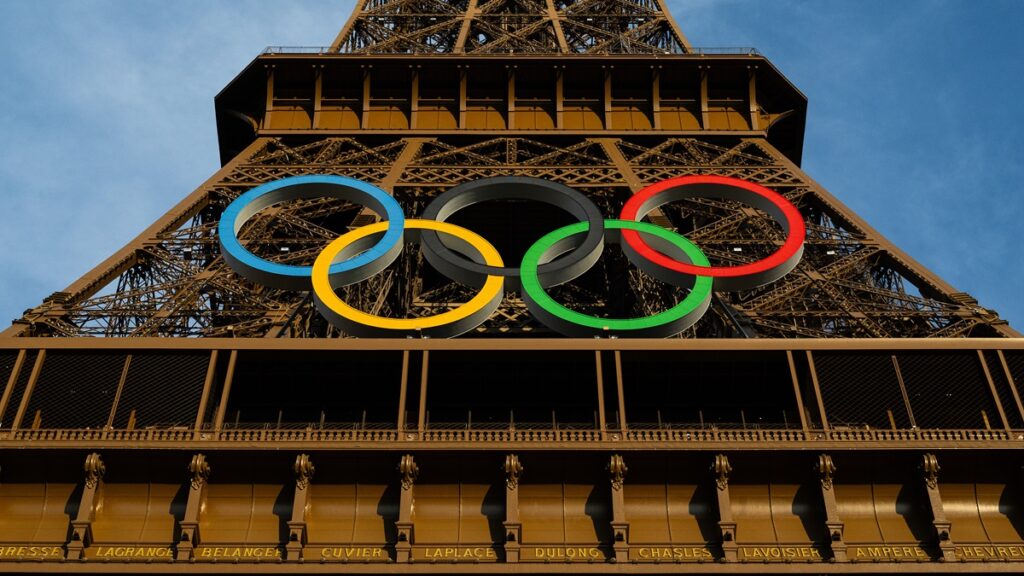

The Paris Olympics are almost upon us (in fact sports including football, archery, rugby sevens and handball have already started) and so it’s time to begin my four-yearly obsession with rhythmic gymnastics, modern pentathlon and sport climbing.

With that in mind, Sam Freedman has done a deep dive into the event on his Comment is Freed substack. He usually posts about politics and international relations (and is well worth a subscribing to on those topics if you don’t already) but is indulging his love of the Olympics to analyse all the sports and Team GB’s medal chances at this year’s event.

For example, did you know we have a real chance of a podium place in artistic swimming (otherwise known as synchronised swimming) this year with a pair in Kate Shortman and Izzy Thorpe who won silver at the world championships. Or that we could win up to four medals in the canoeing?

Unfortunately, there’s no chance of a medal in breaking, or breakdancing, one of the new events at this Olympics. But I’ll be watching anyway.

Read the full post here.

The answer to today’s Business Question is Samir Desai.