Your guide to the autumn Budget

The chancellor Rachel Reeves announced £40bn in tax rises in today's Budget. Here's how the government's plans will affect businesses

(Image: Leon Neal/Getty Images)

(Image: Leon Neal/Getty Images)

Today marks the first Labour Budget in almost 15 years. Much of what was announced in the House of Commons had already been trailed in the media, nevertheless there is plenty in there for business leaders to get their heads around.

But there is only one place to start this newsletter. And that’s with fax machines. As you may have seen, it has emerged that one of the UK’s leading rail operators is still using fax machines to communicate with staff….

That is the headline on the Financial Times story on this. Below is the exchange in a public meeting on Wednesday that led to this information getting out. “We wouldn’t be able to get rid of them tomorrow without an agreement with our trade union,” Tricia Williams, the managing director of Northern Rail, said.

Of course, the reason you are actually reading this article is the Budget. But it feels somehow fitting that this Northern Rail story has emerged on the same day. It provides vital context to what Rachel Reeves has announced and the challenges facing the UK – like ageing infrastructure.

The number you are going to be hearing a lot over the next few days and weeks is £40bn. That is how much the chancellor increased taxes in the Budget. It is more than any other Budget in the 21st Century, including George Osborne’s 2010 austerity Budget and Rishi Sunak’s post-Covid package in 2022.

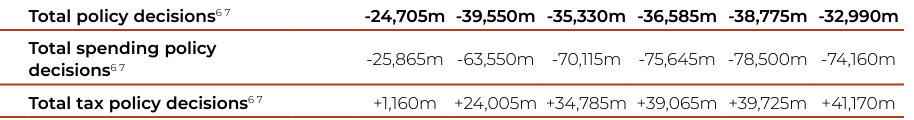

The table below is the summary from the official Budget document. It shows what this all means for the UK public finances each year, starting from 2024-25. As you can see, despite the big tax increases, spending is rising by a lot more. This will be funded by extra borrowing.

The numbers don’t usually look like that in the official Budget document – they are normally a lot smaller. This was a big, consequential Budget. The passion on both sides of the House of Commons was palpable. You could see Jeremy Hunt, the shadow chancellor, muttering “shocking, shocking” as Rachel Reeves spoke, before Rishi Sunak, the Conservative leader, delivered a fiery riposte. He said there had been a “poll tax” on business and a “tidal wave of anti-business rhetoric”.

Of the £40bn increase in annual taxes, about £25bn will come from businesses paying more in employer national insurance contribution. Employer national insurance contributions will go up by 1.2 percentage points to 15 per cent from April, raising £25bn a year by 2028.

Small businesses will get some relief from this. The employment allowance for them will rise from £5,000 to £10,500, helping an estimated 865,000 businesses.

But make no mistake, this was a Budget in which taxes have been increased on businesses and entrepreneurs to pay for increases in spending on public services.

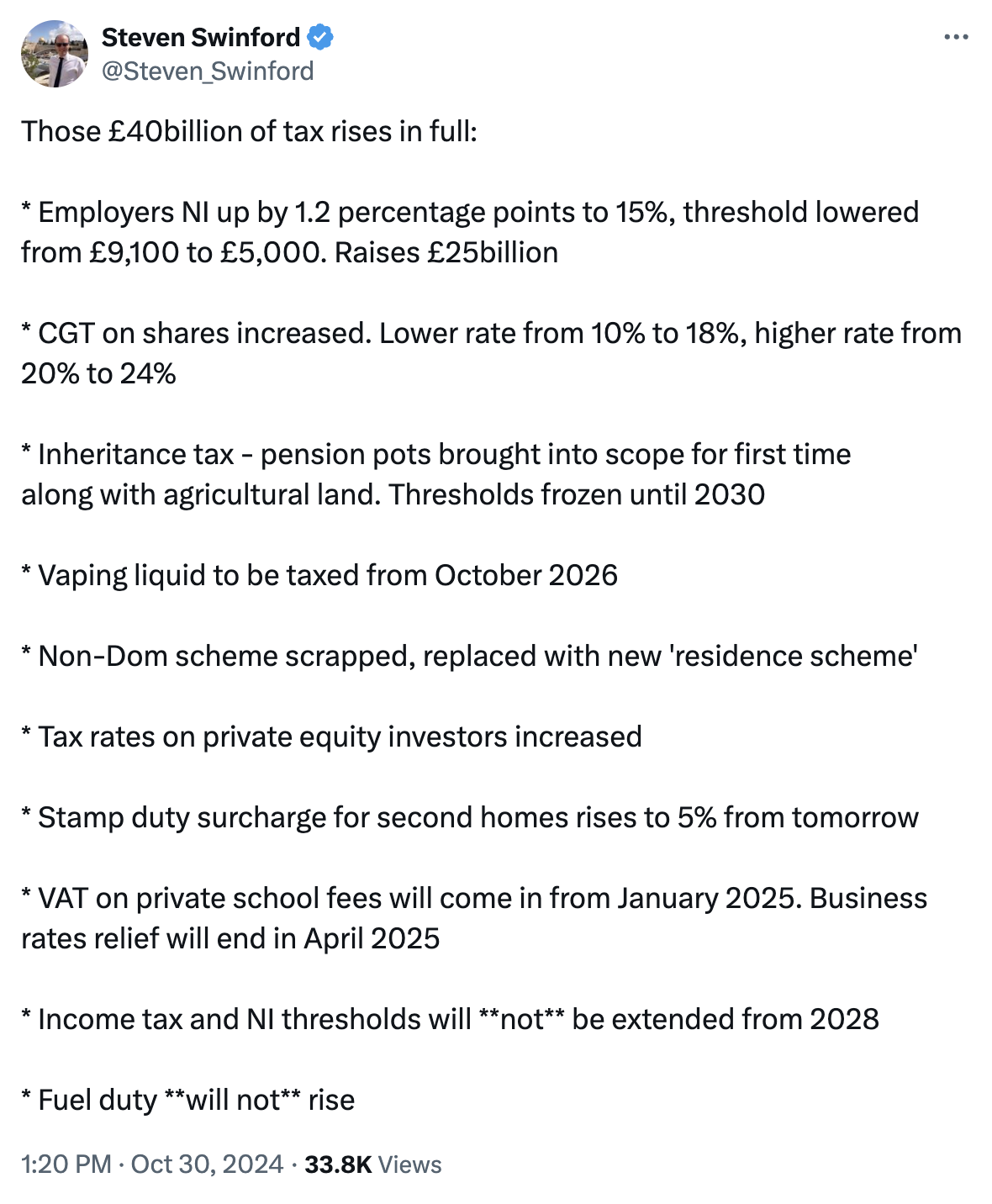

Business Leader’s political expert Steve Swinford has neatly summarised all the tax rises.

Below is some detail on the key tax rises for businesses beyond national insurance.

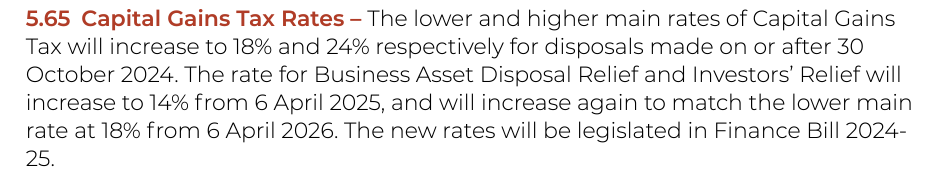

This is the government’s summary of the changes to capital gains tax:

And this is the change to carried interest, which will hit venture capital investors:

Entrepreneurs relief is also changing:

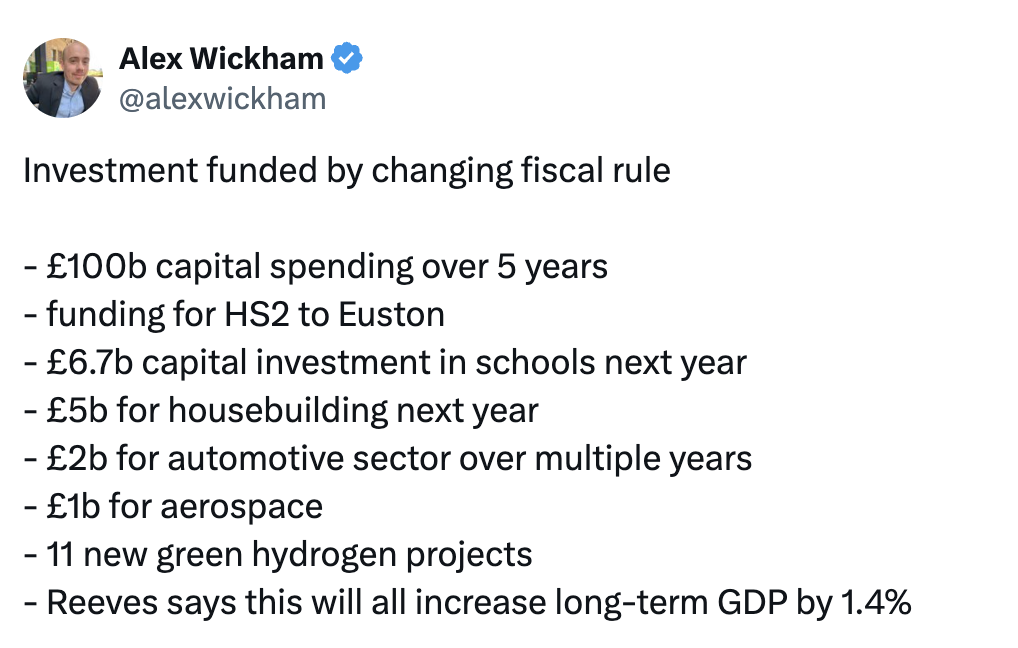

Now on to the details of the spending. This tweet from Bloomberg’s Alex Wickham is a round-up of the new investments.

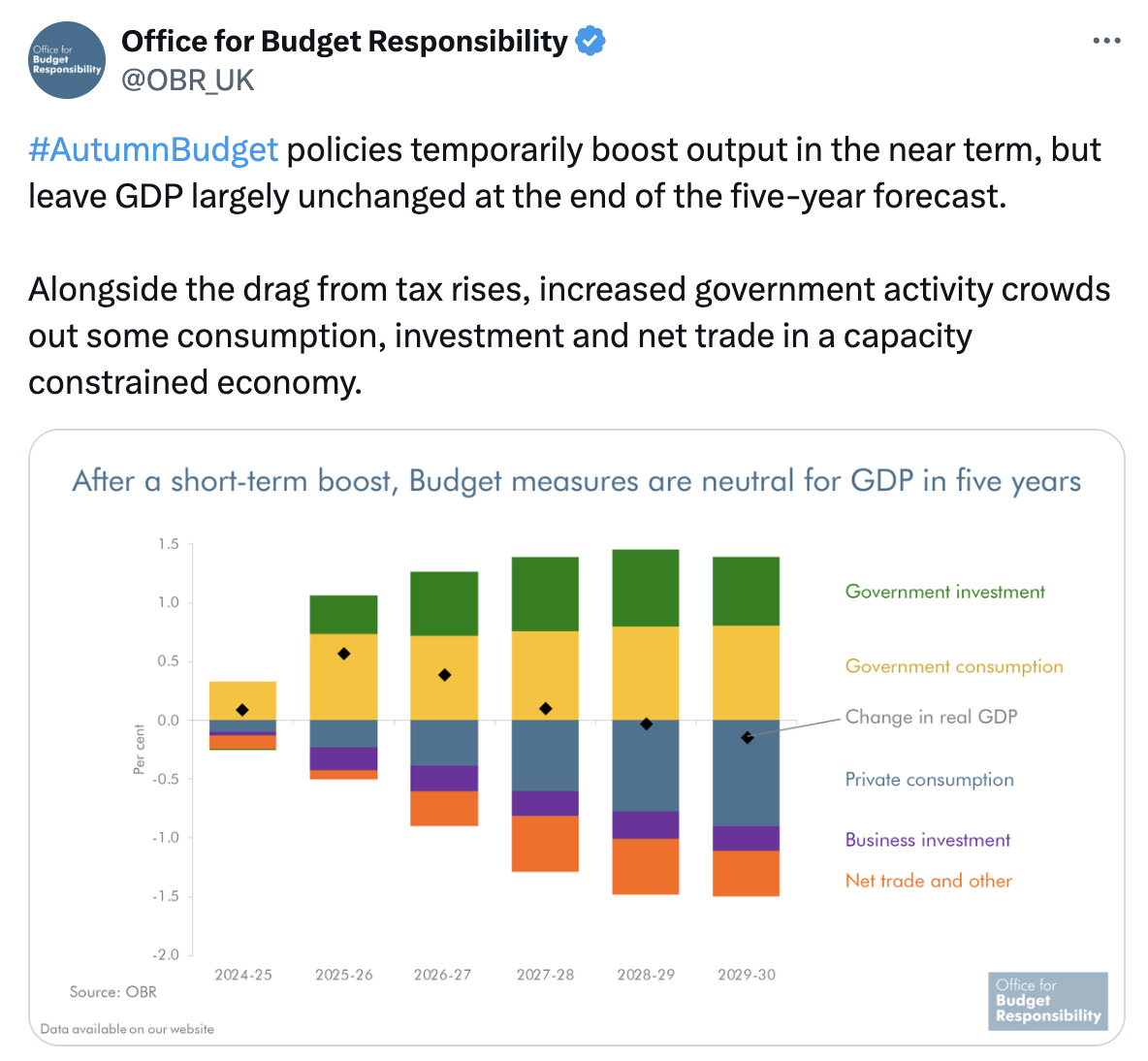

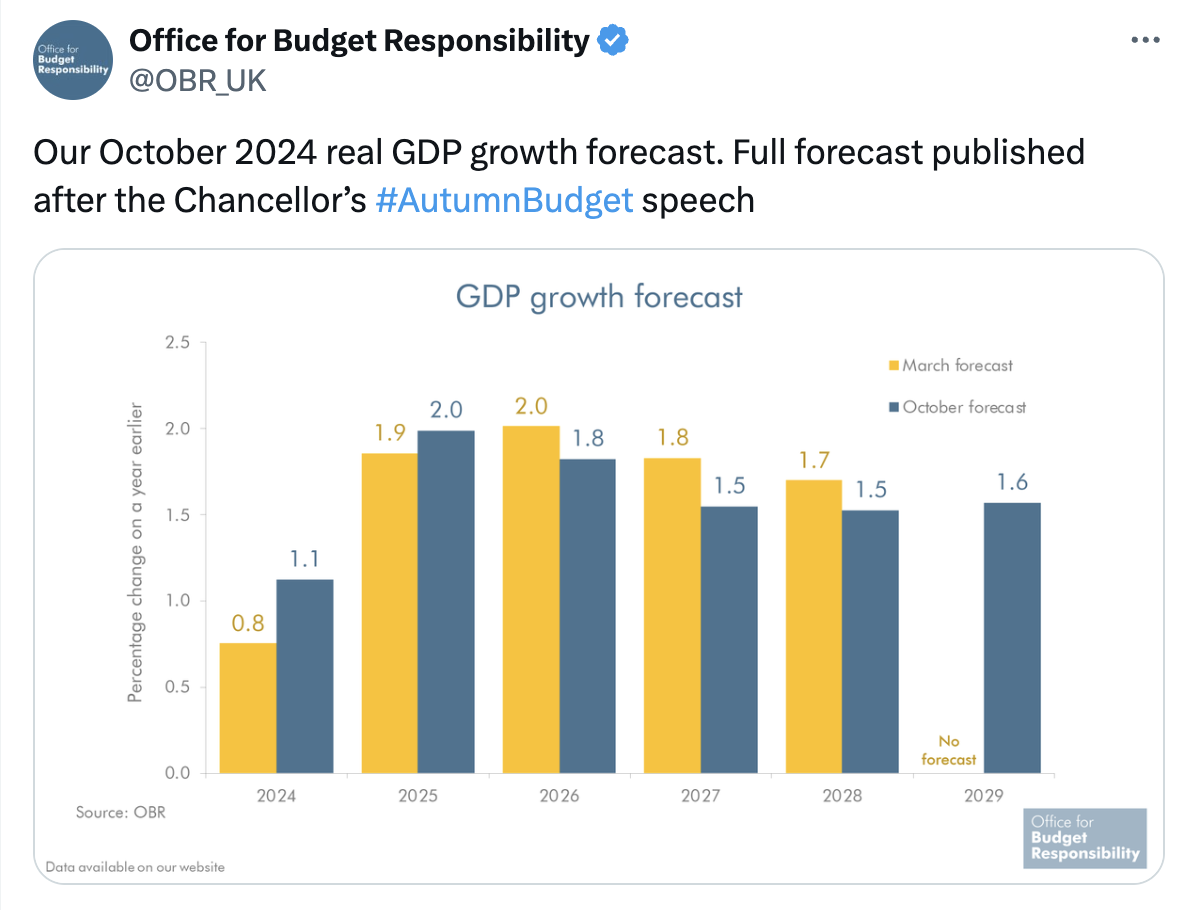

The irony of all these changes to tax and spending is that the Office for Budget Responsibility, the UK’s fiscal watchdog, has forecast that the Budget will barely change GDP over the next five years. There will be a short-term boost from public spending and investment going up, but this will be offset over five years as private consumption and business investment is hit.

This graph summarises the positive and negative changes from the Budget.

And this graph shows the new forecasts for GDP (blue bars) compared to the OBR’s last forecasts in March under the Conservative government (yellow bars).

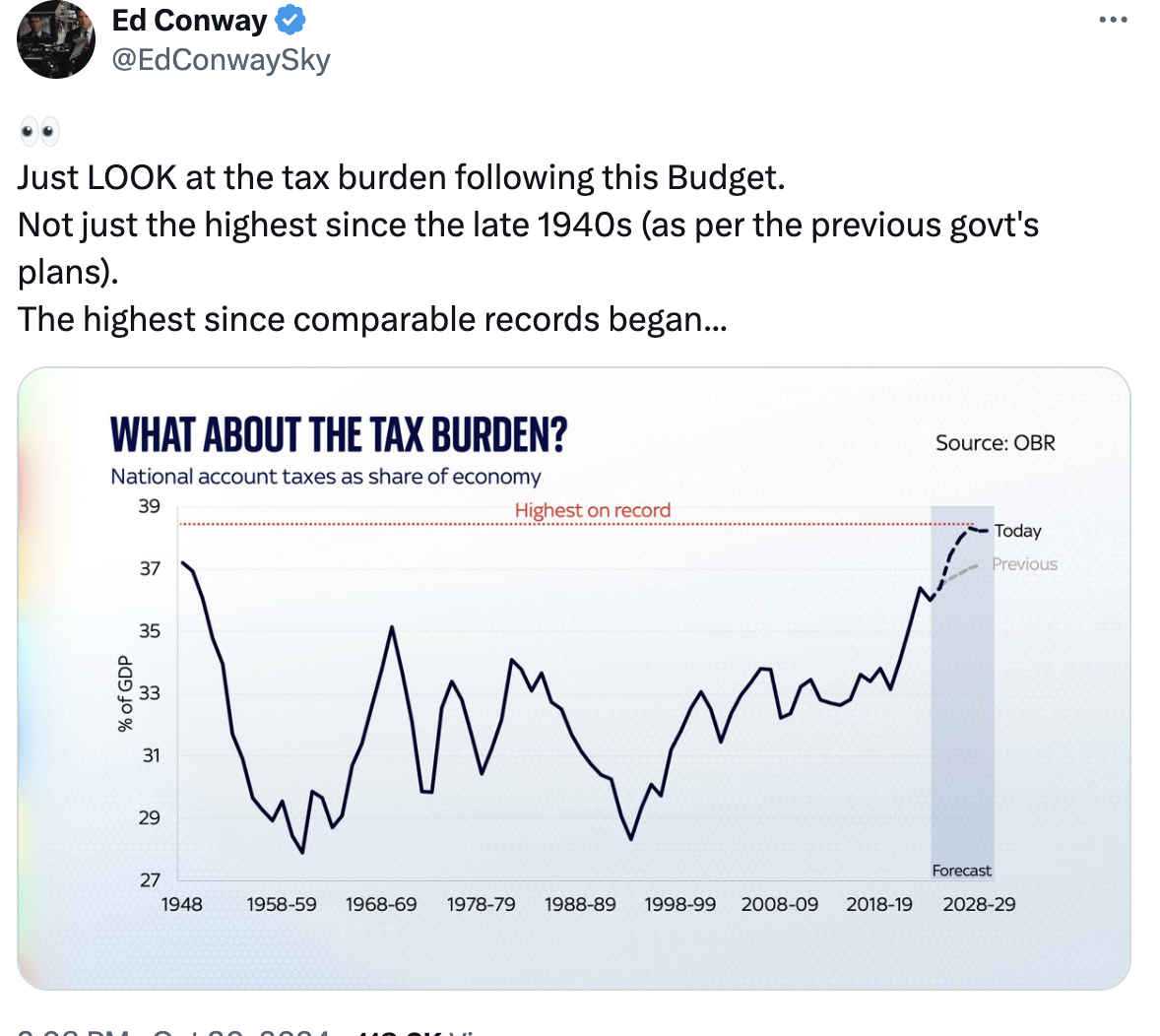

The reason that the OBR is expecting private consumption to be hit is that is that the tax burden is heading to the highest level on record. This graph is from Sky’s Ed Conway.

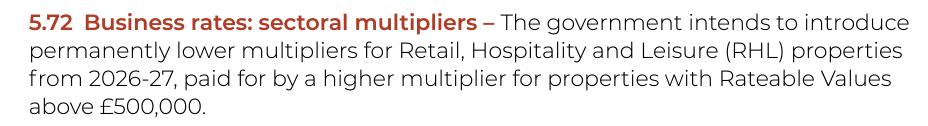

There were some surprises on tax. The chancellor said that the freeze on income tax thresholds will end in 2028, meaning they rise with inflation again. There was also news on business rates, which could boost the retail, hospitality and leisure sectors.

According to the Budget document, this will mean a 40 per cent tax cut for these sectors worth up to £110,000 per business. It amounts to a tax cut of nearly £2bn next year.

The reaction to the Budget has been mixed, to say the least. Roger Barker, director of policy at the Institute of Directors, says: “The government has chosen to impose a significant new tax burden on business as a means of achieving an immediate boost to its public sector spending priorities. The risk is that this will exert a negative impact on business confidence, with worrying implications for the economy’s future growth trajectory.”

Michael Moore, chief executive of the British Private Equity and Venture Capital Association (BVCA), added: “We recognise that the Government has had to balance the need to raise revenue for essential public services with the requirement to keep our economy competitive. The announcement on carried interest recognises that a tax treatment which reflects the long-term, risk-based nature of private capital investments is necessary to ensure that this important UK sector can continue to flourish in an increasingly competitive international environment.”

I will give the final word to the brilliant Paul Johnson at the Institute for Fiscal Studies, the think tank. Johnson is always quickly on top of the Budget numbers. He highlights that the government is now looking to borrow £28bn more in the 2025-26 financial year than previously planned. But only £19bn of that is earmarked for public investment (like rail infrastructure). The rest is for day-to-day spending.

“The first gamble is that a big cash injection for public services over the next two years will be enough to turn performance around, and that many of the temporary spending pressures won’t persist,” Johnson says. “If she’s wrong about that, and spending pressures don’t dissipate after two years, then to avoid cutting unprotected areas she may well need to come back with another round of tax rises in a couple of years’ time – unless she gets lucky on growth.

“Which brings us to the second gamble: that this extra borrowing will be worthwhile. Under pre-election plans we were set to borrow an average of £59bn per year over the next four years. We now expect to borrow an average of £85bn. The hope is that the benefits – from more funding for public services in the next couple of years, and from more public investment throughout the parliament – will more than offset the costs. These costs include higher debt servicing costs but also, according to the OBR, higher inflation and higher interest rates than we’d otherwise have seen.

“A lot hinges on how well the government spends the money. The additional investment is extremely front-loaded, which doesn’t fill me with confidence on how efficiently it will be spent – if indeed it is spent in that timescale. Was this a Budget for growth? The OBR pointed to a short-term sugar rush as a result of the debt-financed spending splurge, but that turns into a modestly negative impact by the end of the parliament.”

You can find the full Budget document here and the OBR’s forecasts here.