Interest rate cut to 5%

Plus, CrowdStrike sued over global outage, the power of taking time off, Bill Ackman withdraws IPO despite “enormous investor interest” and people are not happy about Olympic selfies

This article is an online version of our Off to Lunch newsletter. Sign up to receive it straight to your inbox here.

By Sarah Vizard

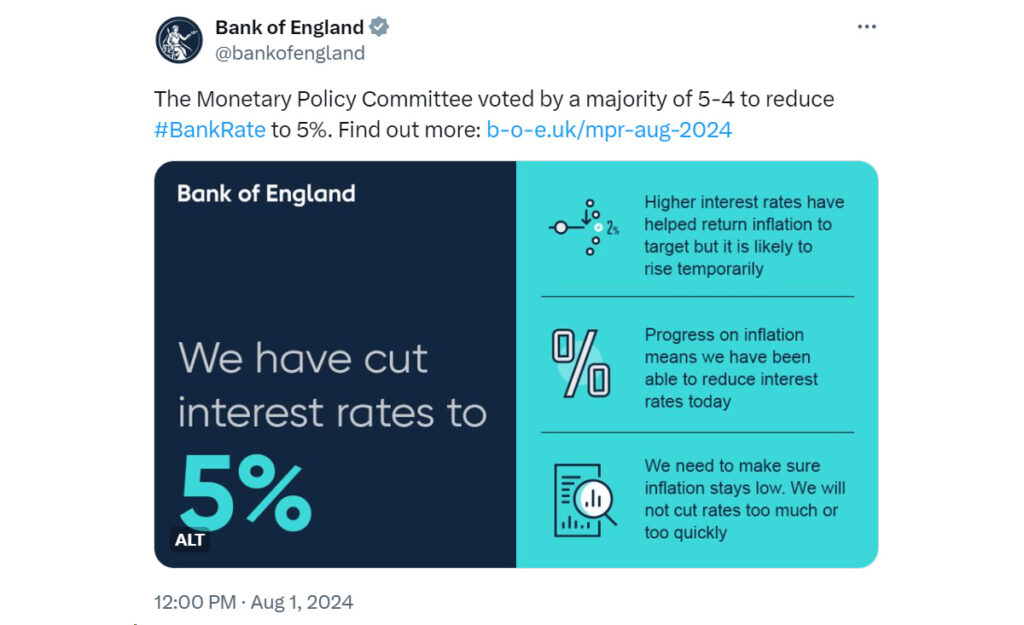

The Bank of England (BoE) has cut the interest rate to 5 per cent, the first reduction since March 2020 when the coronavirus pandemic led to interest rates dropping to 0.1 per cent. The Bank Rate has been at a 16-year high of 5.25 per cent since August 2023 in a bid to temper inflation that hit a high of 11.1 per cent in October 2022.

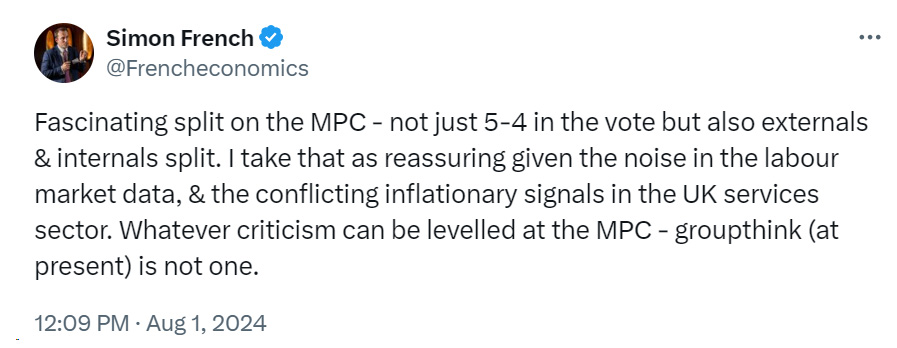

At its meeting on 31 July, the monetary policy committee voted by a majority of five to four to reduce the inflation rate by 0.25 percentage points. Four members voted to maintain the rate. In its reasoning, the BoE says inflation has fallen to its target of 2 per cent, private sector weekly earnings growth has slowed to 5.6 per cent and services inflation had declined to 5.7 per cent, while GDP growth momentum “appears weaker”.

That split was also seen in terms of the external and internal influences on inflation. The five members who voted to cut inflation felt the past external shocks had abated and that domestic inflationary factors could be kept under control. The four who voted for a hold, however, agreed on the external point but felt underlying domestic inflationary pressures “appeared entrenched”.

The chancellor Rachel Reeves has welcomed the move, saying: “While today’s cut in interest rates will be welcome news, millions of families are still facing higher mortgage rates after the mini-budget. That is why this government is taking the difficult decisions now to fix the foundations of our economy after years of low growth, so we can rebuild Britain and make every part of our country better off.”

The decision to cut rates should ease pressure on UK borrowers, if mortgage lenders pass them on. Mortgage rates have gradually been coming down in the past few weeks amid an expectation that the bank would cut rates, although they remain relatively high.

That has led to very little growth in house prices over the past 18 months, although new data from Nationwide shows that in July house prices ticked up by 2.1 per cent, the fastest rate since December 2022.

The UK’s decision is at odds with that of the European Central Bank, which kept its main interest rate at 3.75 per cent at its last meeting two weeks ago. Its chief Christine Lagarde said at the time the decision on a possible cut in September was “wide open”, although inflation in the eurozone has since ticked back up to 2.6 per cent.

In the US, meanwhile, the US central bank appears to be moving closer to lowering interest rates for the first time in more than four years, despite deciding to hold them at their meeting this week. Federal Reserve chairman Jerome Powell says a cut “could be on the table” at its next meeting in September. His comments come as the bank comes under mounting pressure to cut rates amid fears an economic slowdown could become a downturn if it takes too long to reduce them.

“We have to weigh the risks of going too soon against the risks of going too late,” said Powell a press conference. “It’s a very difficult judgement.”

This highlights the tricky balancing act facing central banks. Globally, economic growth remains weak and there are signs the job market is slowing. But inflation is proving sticky.

Business Agenda

A summary of the most important business news

1. CrowdStrike is facing a lawsuit from shareholders after a faulty software update crashed more than 8 million computers worldwide and caused mass disruption. The lawsuit claims the company made false statements about its software testing, leading to a 32 per cent drop in share price and a $25bn loss in market value. CrowdStrike denies the allegations. You can read more here.

2. UK chip designer Arm Holdings reported a 39 per cent increase in quarterly revenue, surpassing analyst expectations, and forecasts second-quarter sales in line with Wall Street estimates, but shares fell 9 per cent in extended trading. Despite a strong performance, Arm’s stock remains highly valued relative to peers like Nvidia, reflecting high investor expectations for future AI-related growth. You can read more here.

3. Clothing chain Next reported better-than-expected sales and raised its annual profit forecast despite a wet start to the summer. Sales rose by 3.2 per cent between April and June, surpassing expectations by £42m, leading the company to increase its full-year profit guidance by £20m to £980m. The boost came from a significant increase in overseas online sales and successful acquisitions, including FatFace and an increased stake in Reiss. You can read more here.

4. Billionaire hedge fund manager Bill Ackman has withdrawn the proposed IPO for Pershing Square USA, despite earlier predictions of it being one of the largest ever. This abrupt reversal follows a challenging period, including a significant investor backing out and reduced fundraising targets. Although Ackman cited strong investor interest, concerns over the fund potentially trading at a discount post-IPO led to the decision to re-evaluate its structure. You can read more here.

5. A group of more than 100 Silicon Valley investors, including Mark Cuban and LinkedIn co-founder Reed Hastings, have launched a website supporting Kamala Harris for the 2024 presidential election. The site, vcsforkamala.org, expresses backing from venture capitalists, founders and tech leaders who favour pro-business, pro-entrepreneurship and pro-technological progress policies. This initiative is in contrast with right-leaning tech moguls like Peter Thiel and highlights Harris’s recent surge in the race following Joe Biden’s withdrawal. You can read more here.

Business Question

How many tourists visited the UK in 2023?

A. 29 million

B. 31.2 million

C. 38 million

D. 42 million

The answer can be found at the bottom of the page.

Business Thinker

Deep dives on business and leadership

By Dougal Shaw

Tell me what sport you play… and I’ll tell you what skills you’ve developed!

With the Olympics in full swing, many of us have our minds fixed on sport. It’s pretty well established in coaching literature that sport has valuable lessons to teach the business community. So, I’ve been intrigued by a study that looks at the connection between amateur sporting activity at university and nascent business skills.

The EDHEC business school has campuses in Nice, Lille, Paris, London and Singapore. It surveyed 2,600 of its students to try and find out the relationship between the sports they chose to play and the skills they were developing. Some findings I found intriguing, like:

- Combat and adversarial sports are good for developing critical thinking.

- Artistic, acrobatic or sports involving the figure (eg skating) are good for developing attention to detail.

- In terms of favoured positions in team games, defenders tend to be people who will be ‘committed’ to their work (ie motivated by the company’s mission, culture, values and usefulness).

- The sport that develops the skills that recruiters value the most is apparently… tennis! So, the future is looking bright for Andy Murray post-retirement, though he is involved in many business endeavours already.

You can read the full piece here.

Business Quote

Inspiration from leaders

“You can have it all. Just not all at once.”

– Oprah Winfrey

Business Leader

The best of our content

Jake Humphrey on the power of taking time off

Taking time to relax isn’t just a luxury – it’s a necessity. Recent statistics show a significant reduction in heart attacks and strokes for those who use their full holiday allocation. Yet, beyond vacations, finding daily moments of calm is crucial.

In this personal exploration, Jake Humphrey, host of the High Performance podcast and co-founder of Whisper Group, challenges the toxic culture of overworking.

From the simple joy of mowing the lawn to the profound importance of family moments, he shares how small changes and a shift in perspective can lead to a healthier, happier, and more fulfilling life.

Read the article here.

Other popular pieces

🌍 Meet the business leader helping companies expand to Africa

✍️ The power of a story: Redefining success in a data-driven world

💬 5 insights language-learning companies can offer us

And finally…

Have you noticed the selfies being taken at the Olympics by the medallists while they are on the podium? It’s part of a sponsorship deal between Samsung and the organisers of Paris 2024.

The Olympics have traditionally been free of sponsorship and branding while the competitions are taking place (look at the lack of advertising boards in the Stade de France when the athletics starts on Friday).

However, businesses have struck some innovative product placement deals with the organisers for this Olympics, such as Samsung smartphones being used to take photos.

The Financial Times has looked at these deals in an interesting piece that you can read here. Not everyone is happy about them…

The answer to today’s Business Question is C. 38 million.